Loading…

Loading…

What is Bitcoin Open Interest?

Bitcoin Open Interest is a useful metric that measures the total value of all active Bitcoin futures contracts that have yet to be settled. In other words, it represents the sum of all long and short positions in the Bitcoin futures market at any given time. This metric provides valuable insights into the overall trading activity and market sentiment surrounding Bitcoin’s future price movements.

By examining open interest, traders can gauge the current liquidity and interest levels. This supports their decision-making process.

Observing changes in open interest can reveal whether new investments are being made in the contract or if capital is moving elsewhere. These shifts can signal market sentiment and potential future price movements, making open interest a useful tool for identifying trends and strategic opportunities in the market.

When open interest rates are high, it typically indicates that there is a substantial amount of capital flowing into the Bitcoin futures market. This increased level of investment can be interpreted in various ways. On one hand, it may suggest strong investor confidence and a bullish outlook on Bitcoin’s future price. Investors may be opening long positions on centralized exchanges such as Binance, Bybit or OKX, expecting the price to rise in the near future.

On the other hand, high open interest rates can also be a sign of increased market speculation. Traders may be taking on larger positions, both long and short, in anticipation of significant price swings. This speculative activity can contribute to heightened volatility in the Bitcoin market.

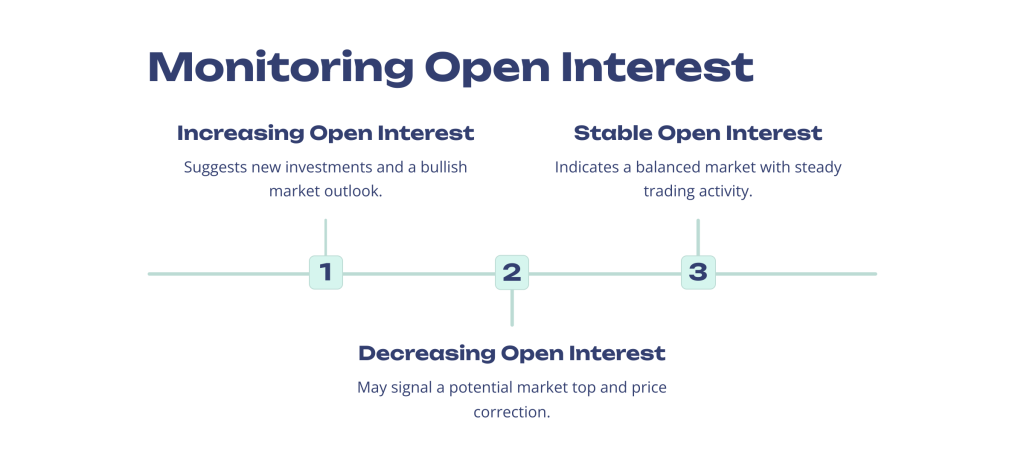

Monitoring changes in open interest rates over time can provide a clearer picture of market trends. If open interest is consistently rising alongside an increase in Bitcoin’s price, it may indicate a sustainable upward trend. Conversely, if open interest is declining while prices are rising, it may suggest a potential market top and a forthcoming price correction.

Investors and traders often use open interest rates in conjunction with other technical and fundamental analysis tools to make more informed decisions. By understanding the implications of high or low open interest, market participants can better gauge market sentiment and adjust their strategies accordingly.

Understanding Bitcoin Open Interest

Bitcoin Open Interest (OI) measures the total number of active positions in the Bitcoin derivative contracts. Unlike trading volume, which includes all transactions, OI only focuses on currently active contracts.

The value of Open Interest lies in its ability to show how many participants are actively engaged in the Bitcoin contract. This can help traders gauge market sentiment and the flow of investments.

For example:

- High OI: Indicates new funds are entering the market.

- Low OI: Suggests funds might be leaving or being redirected.

Why is Bitcoin’s Open Interest Useful?

Traders monitor Bitcoin’s open interest to gauge the strength of market trends in futures and options trading. When open interest rises, it indicates that new Bitcoin contracts are being created, often seen as a sign that the current trend is strong. In contrast, a fall in open interest means traders are closing their positions, which can suggest the trend is weakening.

For instance, consider a Bitcoin option with an initial open interest of 6. If an investor creates 10 new contracts, the open interest climbs to 16. If a trader closes 3 of these and another investor starts 5 new ones, open interest increases by 2, reaching 18. This illustrates how open interest fluctuates based on trading activities.

Open Interest vs Trading Volume

Both open interest and trading volume are key metrics in assessing Bitcoin’s price action and trend, but they capture different aspects of the underlying market activity. Trading volume refers to the total number of shares or contracts traded within a certain period, highlighting the market’s liquidity and activity level.

In contrast, open interest counts the number of contracts that are still active in the market, showing the obligations of all traders. Unlike trading volume, open interest only includes contracts that haven’t been fulfilled by delivery or canceled by another trade.

Understanding these metrics can help traders make more informed decisions.

The Importance of Bitcoin Open Interest in Crypto Trading

Bitcoin Open interest is an important metric in trading, as it offers insights into Bitcoin’s market sentiment and potential trend shifts. It reveals traders’ engagement and the start of new positions, as well as the prospects for trends based on changes in market participants’ commitments.

Key points about open interest:

- Provides data on market sentiment and trend changes

- Reflects traders’ activity and new positions

- Serves as a foundation for various trading strategies

Monitoring changes in Bitcoin’s open interest enables traders to gauge shifts in sentiment. It also helps predict future movements in the Bitcoin futures market. This information can be useful for coming up with effective trading strategies.

For example, rising Bitcoin price coupled with an increase in open interest suggests a strong upward trend and momentum. This reflects positive market sentiment and consensus among traders. In contrast, increasing open interest with declining prices indicates persistent selling pressure and a bearish market outlook.

By analyzing and tracking open interest, traders can make more informed decisions. This can potentially enhance their trading strategies and outcomes. This emphasis on data helps traders understand market dynamics and respond appropriately to shifting trends.

Other useful metrics for enhancing one’s understanding and decision-making regarding the cryptocurrency markets include crypto funding rates or total value locked (TVL) trackers and ETF trackers.

WRITTEN

Benjamin Vitaris

Seasoned crypto, DeFi, NFT and overall web3 content writer with 9+ years of experience. Published in Forbes, Entrepreneur, VentureBeat, IBTimes, CoinTelegraph and Hackernoon.