What is Aave (AAVE)?

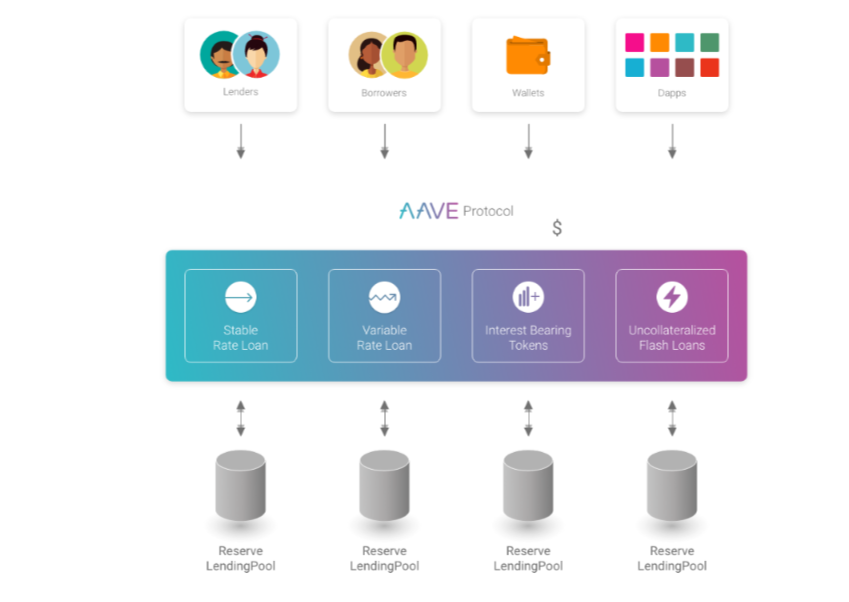

Aave is a decentralized finance (DeFi) platform that enables users to borrow and lend crypto. The platform uses smart contracts to automate the lending process, with preset rules on how funds are distributed, how collateral is handled, and how fees are determined. It’s successfully positioned itself as a leading DeFi protocol and has billions of dollars locked in its smart contracts.

Key Takeaways

- Aave is a decentralized crypto lending platform that allows users to borrow and lend crypto.

- The Aave blockchain uses the native AAVE token to pay for fees and incentivize validators.

- Aave specializes in overcollateralized loans, which means that users will need to deposit crypto worth more than the amount that they wish to borrow.

- Aave borrowers risk liquidation of collateral if the value of that collateral drops too far.

- The AAVE token has rallied by around 100% in 2023.

What Is The history of Aave (AAVE)?

Aave, formerly known as EthLend, emerged in January 2017 as a revolutionary decentralized finance (DeFi) protocol, revolutionizing the traditional lending and borrowing process by eliminating the need for intermediaries1. Pioneered by Stani Kulechov2, Aave swiftly gained traction, establishing itself as one of the most widely adopted DeFi protocols.

In March 2017, Aave unveiled its inaugural liquidity market for Ether (ETH), signaling the commencement of its journey into the decentralized finance realm. Just six months later, Aave expanded its reach by incorporating a broader spectrum of ERC-20 tokens3, widening its appeal and providing users with a diverse range of assets to deposit and borrow.

2018 marked a pivotal year for Aave’s evolution. In February, the protocol introduced flash loans4, a feature that enabled users to borrow substantial amounts of cryptocurrency without putting up collateral, provided they could repay the loan within the same block.

2020 brought significant advancements to Aave, with the launch of its Aave V2 protocol in January. This iteration introduced a host of improvements, including enhanced scalability, bolstered security, and support for expanded features, further solidifying Aave’s position as a leading DeFi protocol.

2022 brought further advancements, with Aave announcing its plans to establish a decentralized autonomous organization (DAO) to oversee the development of the protocol, empowering the community to shape its future. In 2023, the DAO voted to launch the GHO stablecoin on the Ethereum network5.

In 2023, Aave unveiled its plans to launch a decentralized exchange (DEX) powered by the Aave protocol, providing an integrated platform for users to swap their cryptocurrencies seamlessly within the Aave ecosystem.

This year, the team has also inaugurated its Aave Developer Portal, a comprehensive resource center designed to empower developers with the tools and knowledge necessary to build innovative applications upon the Aave protocol, fostering further growth and expansion of the DeFi ecosystem.

How Does Aave Work?

Aave is an Ethereum-based protocol that offers automated crypto loans, and it operates without the need for a third-party intermediary. Aave uses smart contracts, which are programs that automate the borrowing process by calculating the loan terms, collecting the deposited collateral, and distributing the cryptocurrency being borrowed. The Aave (AAVE) token, which is an Ethereum-based token, is used to pay for transaction fees and secure loans.

Aave is known for its overcollateralized loans, which protect lenders from losing money due to loan defaults. Users must deposit crypto worth more than the amount they wish to borrow, and the protocol can liquidate the collateral if it drops too much in value. This ensures that lenders are protected from losses and the platform can maintain its liquidity.

In summary, Aave is a decentralized lending platform that uses smart contracts to automate the lending process. It requires collateral, offers a native token that can earn interest through staking, and specializes in overcollateralized loans to protect lenders from losses.

Aave Lending

To lend crypto on Aave, users connect a crypto wallet to the platform and search through a list of assets that support deposits. Deposits offer a fixed annual percentage yield (APY) that is paid out in the same asset in which it is deposited. Aave offers access to several cryptocurrencies, including Ether (ETH), Dai (DAI), Aave (AAVE), U.S. Dollar Coin (USDC), and Tether (USDT).

Supplying crypto to Aave adds your tokens to liquidity pools, which are used for lending to other borrowers. The interest rate paid by borrowers goes to the lending pools, with a percentage of those fees being paid out to depositors.

What is the Aave Borrowing Process?

To borrow crypto on the Aave platform, users will need to first supply crypto on the platform as collateral. Once the collateral is deposited into the liquidity pools, users actually earn interest on these deposits. Once funds are deposited, users can search through the supported crypto assets to borrow, and Aave automatically calculates how much they can borrow.

All Aave loans are overcollateralized, meaning that the value of the assets deposited will always exceed the value of the crypto loan. Aave limits borrowing to protect lenders and liquidity providers from losing money if the loan collateral drops in value.

Why are Aave Flash Loans a big deal?

Aave offers Flash Loans, which are loans that are borrowed and repaid within the same block. These loans are designed to take advantage of arbitrage opportunities in the crypto market, such as a price difference between cryptocurrencies on different crypto exchanges. They allow traders to take advantage of swings in the market by gaining more exposure. However, these loans are very risky as they must be repaid within a very tight window of time.

What are the Risks of using Aave?

Here are some of the risks that users should be aware of before using Aave:

Liquidation Risk

One of the biggest risks of using Aave is liquidation risk. If a user pledges a volatile crypto asset like ETH as collateral and the value of that asset drops too far, the asset may get liquidated. If the value of the collateral for a crypto loan on Aave drops below a certain LTV, the platform can automatically pay back part of the loan through liquidation.

This process involves selling up to 50% of the pledged collateral to pay back the loan and bring the LTV back within the limits of the loan agreement. Liquidations are processed by “liquidators,” which are users who can repay the loan and claim the collateral (plus a 5% bonus).

No Insurance

Another risk of using Aave is that the platform does not offer insurance. This means that user funds are not protected, and lost funds or crypto sent to the wrong address will not be reimbursed. As with other decentralized crypto platforms, there is no Federal Deposit Insurance Corp (FDIC) insurance.

Market Volatility

Cryptocurrency is inherently volatile, and using crypto assets to pledge collateral for a loan can result in a significant loss for the user. The funds are locked into the contracts and cannot be accessed until the loan is paid off.

How to Use Aave?

To use Aave, users need to log into the Aave web app and connect a digital wallet to deposit crypto onto the platform. Once the funds are deposited, users can choose from a list of supported cryptocurrencies to borrow against the collateral deposited. Aave is an automated platform governed by smart contracts, meaning loans are handled instantaneously. Once a loan is confirmed, the crypto will be deposited into a user’s crypto wallet.

Is Aave Safe?

Aave relies heavily on smart contracts to handle all the transactions on the platform. While these contracts are designed to be secure, they could be compromised, and hackers could gain access to the funds on the platform. In 2022, Aave Flash Loans were used to drain more than $80 million in Ether (ETH) into a hacker’s wallet, although Aave was not technically compromised in the attack. It’s worth noting that Aave has a considerable amount of value locked in its smart contracts, which suggests a high level of stability.

What Fees does Aave charge?

Aave charges several fees on its platform, including borrowing fees and network fees. Borrowing fees for Aave loans are variable and fixed-rate, ranging from 2% to 30%+ annual percentage yield (APY) or more. Flash loans, on the other hand, charge a 0.09% fee per transaction. Additionally, Aave requires network fees, also known as gas fees, to be paid on all transactions. These fees are for node operators and validators on the Ethereum network. Fees are subject to change.

How Does Aave Pay Interest?

Aave pays interest to lenders by collecting interest from borrowers via loans. Lenders who deposit cryptocurrency into an Aave liquidity pool earn interest in the form of the deposited cryptocurrency. The interest rate paid to lenders depends on the borrowing rate and the supply and demand ratio of the asset. Aave offers both variable and stable interest rates.

How has AAVE traded in 2023, and what are the price predictions?

As you can see from the TradingView chart below, AAVE has had a stellar 2023 following a massive crash during the 2022 bear market. It has rallied by nearly 100% this year, and its market capitalization of $1.4 billion puts it in the top 50 cryptos, according to CoinGecko6.

Aave price predictions are generally optimistic in the long run with CoinCodex forecasting a target of over $250 in 20257. However, market volatility can quickly derail price targets in the crypto space, so always do your own research.

The Bottom Line

Aave is a decentralized lending platform that facilitates borrowing and lending of cryptocurrencies. It operates on an Ethereum-based protocol and uses smart contracts to automate the process. Aave offers overcollateralized loans, which require users to deposit crypto worth more than the amount they want to borrow. This protects lenders from losing money due to loan defaults and gives Aave the ability to liquidate the collateral if its value drops too much.

The Aave protocol survived the bear market and is now on the rise. Its native token has rallied by over 100% this year, and the total value locked across its smart contracts is above $6 billion, putting it amongst the leading DeFi protocols.

Frequently Asked Questions

Where can you Buy AAVE?

AAVE is a widely traded cryptocurrency that can be purchased on most leading crypto exchanges, including Binance, Coinbase, and Kraken.

How does Aave work?

Aave is a decentralized lending protocol that uses smart contracts to automate the borrowing and lending process. Lenders deposit cryptocurrencies into liquidity pools, and borrowers can take out loans by depositing collateral, such as another cryptocurrency or stablecoin. Interest rates are determined by supply and demand, and borrowers are responsible for repaying their loans with interest.

What are the fees for using Aave?

Aave charges several fees for its services, including:

Borrowing fees: Borrowing fees are charged to borrowers and range from 2% to 30%+ annual percentage yield (APY) or more.

Network fees: Network fees are charged for all transactions on the Ethereum network, and these fees are paid to node operators and validators.

Flash loan fees: Flash loan fees are charged to borrowers and are 0.09% per transaction.

Please note that fees do change, so always check the official website to get the most up-to-date information.

How does Aave maintain liquidity for borrowers?

Aave provides liquidity for borrowers by relying on a decentralized network of liquidity providers. These liquidity providers deposit their cryptocurrencies into liquidity pools, which are used to facilitate lending and borrowing transactions. In exchange for providing liquidity, liquidity providers earn interest on the deposited cryptocurrencies.

WRITTEN

Peter Barker

Peter is an experienced crypto content writer and a DeFi enthusiast with more than 3+ years of experience in the space. Previously a journalist and news editor at a leading European news sourcing agency.