What is Jupiter (JUP)?

Describing itself as a “full stack ecosystem play”, Jupiter is a Decentralized Exchange (DEX) aggregator built on the Solana blockchain.

It currently aggregates liquidity from across 29 integrated DEXs1, giving users the freedom to select the best swap prices available within the Solana ecosystem. The top three pool providers as of January 2024 are Orca, Raydium and Lifinity.

Beyond aiming to provide the “best price, best token selection, and best UX for users and developers,” Jupiter’s mission is to make Centralized Exchanges (CEXs) obsolete. According to Jupiter’s team, there is no benefit to using CEXs once users can access all of the same trading features at the same high standards on a trustless and decentralized platform.

For Jupiter, such features include swaps, limit orders, Dollar Cost Averaging (DCA) and bridging, as well as perpetuals trading which is currently available on beta.

Together with a strong community of ‘Catdets’ and a generous serving of memes2, Jupiter is proving to be an increasingly popular option for trading on Solana.

At the time of writing, Jupiter has registered over $59bn in trading volume, transacted across nearly 87,000 unique wallets.

Key takeaways

- DEX Aggregator: Jupiter, a Solana-based DEX aggregator, consolidates liquidity from 29 DEXs for optimal swap prices.

- CEX Replacement Mission: Jupiter aims to make centralized exchanges obsolete by offering comparable or superior features in a trustless environment, including swaps, limit orders, DCA, bridging, and beta perpetuals trading.

- Key Features and Community: Jupiter features swaps, limit orders, DCA, bridging, and perpetuals trading, alongside an engaged community of ‘Catdets’ using humor and memes.

- Impressive Solana Presence: With over $59 billion in trading volume and nearly 87,000 unique wallets, Jupiter proves increasingly popular for Solana-based trading.

What is the history of Jupiter?

Jupiter was launched in November 2021 by an anonymous team that is represented by the pseudonymised project founder, ‘Meow’. The DEX was originally built as an ‘experiment’ to integrate Mercurial with Serum and help establish greater liquidity for lesser-known stablecoins, TerraUSD ($UST) Parrot USD ($PAI).

When positive results from internal testing combined with enthusiastic feedback from users, the team decided to launch the DEX as a standalone project.

Since then, Jupiter’s developers have been vocal about their belief in the Solana ecosystem and the role they see it playing in onboarding crypto’s next billion users.

With this vision in mind, Jupiter has been positioning itself to “provide the single liquidity endpoint” for a range of stakeholders across verticals that include banking, gaming, and payments. By leveraging liquidity across the ecosystem and creating a seamless trading experience, Jupiter sees itself as contributing to Solana’s scaling efforts.

In the final week of January – playfully renamed ‘Jupuary’ in Meow’s communications – Jupiter is scheduled to release 40% of its upcoming $JUP token in an airdrop to community members and active users.

How does Jupiter work? What is it used for?

Jupiter offers users a range of features including swaps, limit orders, Dollar Cost Averaging (DCA) and Bridging. In addition, it also has a Perpetuals feature in development. As of January 2024, perpetuals are available to traders in beta mode.

Swaps

In a DEX aggregator like Jupiter, swaps function by optimizing decentralized exchanges (DEXs) to provide users with the best possible trading outcomes. When a user initiates a swap, Jupiter scans multiple DEXs for the most favorable rates and liquidity.

The aggregator leverages smart order routing algorithms to split and execute the trade across various protocols, ensuring optimal price execution and minimal slippage.

By aggregating liquidity from different sources, Jupiter enhances efficiency and liquidity for users. This approach not only broadens the range of available trading pairs but also improves the overall trading experience by minimizing price discrepancies. Ultimately, Jupiter and other DEX aggregators play a crucial role in simplifying and optimizing the decentralized trading process, offering users improved access to liquidity and competitive pricing across various blockchain protocols.

Limit orders

Limit orders operate by allowing users to set specific price levels at which they are willing to buy or sell assets. When a user places a limit order on Jupiter, its system monitors multiple decentralized exchanges (DEXs) to identify the most advantageous entry or exit points. The aggregator utilizes intelligent algorithms to execute the limit order when the market reaches the specified price, optimizing for the best available rates across various protocols. This approach empowers users to potentially achieve more favorable pricing than immediate market orders.

By aggregating liquidity from different sources, Jupiter enhances the likelihood of limit orders being filled at the desired price, providing users with increased control and precision in their decentralized trading strategies.

Dollar Cost Averaging

Dollar cost averaging (DCA) involves a systematic approach to investing by spreading a fixed amount of funds across multiple assets at regular intervals. Users can set up recurring purchases through Jupiter’s platform, which then automatically executes buy orders for selected assets at predetermined time intervals. The DEX aggregator scans various decentralized exchanges (DEXs) to find optimal rates for each scheduled purchase. By leveraging this approach, users benefit from price averaging over time, reducing the impact of short-term market volatility on their overall investment. Jupiter’s DCA functionality provides users with a convenient and automated way to accumulate assets gradually, promoting a disciplined investment strategy while optimizing the purchasing process across different blockchain protocols.

Bridging

Bridging facilitates the process of seamlessly transferring assets from one blockchain to another. Jupiter makes bridging possible by integrating multiple blockchain protocols. Users initiate the bridging process by selecting the source blockchain and the target blockchain for their assets. The DEX aggregator then identifies the most efficient bridge or decentralized exchange (DEX) that supports the desired asset transfer. Leveraging its network, Jupiter ensures a smooth and secure transition of assets between blockchains. This bridging capability allows users to access a wider range of decentralized finance (DeFi) opportunities and assets across various blockchain ecosystems, contributing to interoperability and flexibility in decentralized trading and investment strategies.

Perpetuals

In its beta phase, Jupiter’s perpetuals feature on the decentralized exchange (DEX) allows users to engage in perpetual swaps, a type of derivative contract that tracks the price of an underlying asset.

Users can trade perpetual contracts with no expiration date, enabling them to speculate on asset price movements without worrying about contract expiry.

Traders can go long or short on assets, and the perpetual contracts automatically roll over, avoiding the need for manual contract management. Although still in beta, Jupiter’s perpetuals feature provides users with exposure to a diverse range of assets and trading strategies within the decentralized finance (DeFi) space.

Jupiter combines advanced features such as cross-protocol liquidity swaps, limit orders, dollar-cost averaging, and perpetuals on its decentralized exchange (DEX) aggregator. This comprehensive stack optimizes user experience by offering seamless asset bridging, efficient trading strategies, and exposure to a diverse range of assets. By leveraging the benefits of decentralization and interoperability across various blockchains, Jupiter aims to not only compete with, but surpass centralized exchanges, providing users with a flexible, cost-effective, and feature-rich platform for decentralized trading.

How does Jupiter Compare to Others?

In the following table, we break down how Jupiter compares to another leading Solana DEX, called Orca:

| Feature | Jupiter | Orca |

|---|---|---|

| Blockchain | Solana | Solana |

| Year Launched | 2021 | 2021 |

| All-time trading volume | $59bn | $36.6bn |

| Core Functionality | DEX Aggregator | DEX and AMM |

| Special Features | Cross-protocol swaps, Limit Orders, Dollar Cost Averaging, Perpetuals | Rust Oracle, Yield Farming |

| User Experience | Comprehensive and diverse decentralized trading functionalities | Intuitive with a focus on decentralized asset management and farming |

What are the Tokenomics of Jupiter (JUP)?

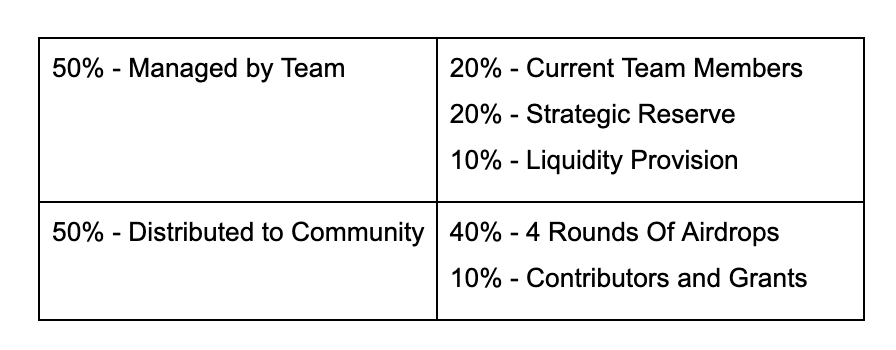

In a statement published on X, Meow revealed that the token distribution will be equally divided between the team and the community3. The logic behind this split is to enable the team to invest in recruiting ‘world class talent’, as well as in a solid product build and strategy while also benefitting from crypto’s community network effects.

The token release and allocation strategy tie into Jupiter’s ‘Grow the Pie’ strategy, outlined in the DEX aggregator’s Green Paper.

What are the most traded token pairs on Jupiter?

Here are the top 5 most traded token pairs on Jupiter as of January 9th 2023:

What does Jupiter offer for developers?

Jupiter Exchange offers a range of tools and features for developers, including:

- V6 Swap API: Described as “the most powerful swap API in DeFi”, V6 Swap API enables developers to easily access liquidity on Solana.

- Payments API: This empowers merchants to accept a variety of tokens, while seamlessly converting them to USDC.

- Gaming: This tool enables game developers to effortlessly integrate swapping functionality into their gaming user interfaces.

Moreover, developers have access to APIs that cater to functionalities such as Limit Orders, Token Listings, Dollar Cost Averaging (DCA), and more, providing them with versatile options for enhancing and customizing their decentralized trading experiences.

Final thoughts on Jupiter

Jupiter, a Decentralized Exchange (DEX) aggregator on the Solana blockchain, aims to revolutionize decentralized trading. With a user-friendly interface and a commitment to offering the best prices, token selection, and user experience, Jupiter aggregates liquidity from 29 integrated DEXs, currently dominated by Orca, Raydium, and Lifinity.

Launched in November 2021, it has grown to register over $59 billion in trading volume across nearly 87,000 unique wallets. Jupiter’s mission is to make Centralized Exchanges (CEXs) obsolete, offering features like swaps, limit orders, Dollar Cost Averaging (DCA), bridging, and perpetuals trading.

Positioned as Solana’s liquidity endpoint, Jupiter contributes to the ecosystem’s scaling efforts, with a 40% $JUP token airdrop scheduled for January 2024. With a strong community and innovative features, Jupiter emerges as a popular choice for decentralized trading on Solana.

Frequently asked questions

What is Jupiter’s mission? how Is Jupiter different from other decentralized exchanges (DEXs) on Solana?

Jupiter’s mission is to render centralized exchanges obsolete by providing the best pricing, token selection, and user experience. It stands out on Solana by aggregating liquidity from 29 integrated DEXs, offering features like swaps, limit orders, Dollar Cost Averaging (DCA), and bridging. Jupiter’s commitment to decentralized and trustless trading, coupled with a strong community, positions it as a leading DEX on Solana, contributing to the ecosystem’s scaling efforts.

What is the utility of Jupiter?

Importantly, $JUP will serve as a governance token within the JUP DAO, unlocking voting rights for holders4. Meow has stated that their long term vision for the DAO is to create “the most productive DAO in the history of crypto not just for Jupiter but for advancing the whole crypto ecosystem forward.

How does Jupiter’s DEX aggregator work? what benefits does Jupiter provide to users in terms of liquidity and trading efficiency?

Jupiter’s DEX aggregator optimizes decentralized exchanges (DEXs) by scanning multiple sources for the best trading rates and liquidity.

Leveraging smart order routing algorithms, it executes trades across various protocols, minimizing slippage and ensuring optimal price execution.

By aggregating liquidity from diverse platforms, Jupiter enhances trading efficiency, broadens available trading pairs, and offers users improved access to liquidity and competitive pricing. This approach not only simplifies the decentralized trading process but also significantly enhances overall trading experience on the Solana blockchain.

How can community members and active users participate in it during ‘Jupuary’?

The first of four rounds of airdrops is scheduled for the final week of January 2024. The snapshot to qualify for this initial round of airdrops was taken in November 2023.

Users had to have traded a minimum of $1,000 worth of tokens prior to the snapshot. Users can check their eligibility here and are advised to monitor the exchange’s official X account and other social media pages for updates on future ways to qualify.

While airdrops provide an exciting mechanism to incentivize users to engage with and help build decentralized protocols, airdrop farming in DeFi involves risks such as potential scams or fake projects aiming to exploit user participation.

WRITTEN

Mariquita de Boissière

Through storytelling and detailed research, Mariquita connects the brightest developer talent and most motivated community members to web3 changemakers. From contributing top-of-funnel educational content for web3 onboarding projects like Surge.io to collaborating with Hedera’s HBAR Foundation on content marketing strategy, Mariquita has worked with some of the top artists, founders and builders in the space.