What Is Frax?

Frax has developed a stablecoin protocol that combines asset collateralization and cryptography to create a stablecoin pegged to the US dollar. The decentralized stablecoin is designed to maintain a peg to the US dollar through asset backing and a mint/burn mechanism1.

Frax’s stablecoin protocol also includes the Frax Shares (FXS) governance and utility token, which is used to support the platform’s various functions. The Frax crypto protocol utilizes subprotocols like Fraxlend, Fraxswap, and Fraxferry to integrate its stablecoins and provide stability mechanisms. In this article, we will explore the features of Frax’s stablecoin protocol, including how FRAX tokens are minted, liquidity pools, rewards, and staking Frax tokens.

Key Takeaways

- Frax has developed a stablecoin protocol backed by both asset collateralization and mathematical cryptographic algorithms.

- The protocol includes asset-backed and algorithmic stablecoins, as well as the Frax Shares (FXS) governance and utility token.

- The protocol utilizes subprotocols like Fraxlend, Fraxswap, and Fraxferry to integrate its stablecoins and provide stability mechanisms.

What Is The History of Frax?

Frax Finance launched in 2020 as a novel decentralized stablecoin protocol designed to bridge the gap between collateralized and algorithmic models. Founded by Sam Kazemian and others, Frax initially employed a hybrid approach, anchoring its US dollar peg with both real-world assets and an algorithmic mechanism fueled by the governance token FXS2. This innovative scheme aimed to achieve price stability without the inflationary pressures of purely algorithmic models.

The core of Frax lies in its two-token system: FRAX, the stablecoin maintaining a tight tether to the dollar, and FXS, the governance token granting holders voting rights on protocol decisions3. Algorithmic Market Operations (AMOs) dynamically adjust supply and demand to safeguard the peg by minting or burning FXS in response to market forces4.

Notably, a 2023 community vote steered the protocol towards full collateralization, with AMOs remaining active to manage potential depeg risks.

Beyond its stablecoin core, Frax boasts a burgeoning ecosystem of subprotocols. Fraxlend facilitates decentralized lending, Fraxswap offers a native decentralized exchange, and Fraxferry enables cross-chain bridging5.

However, Frax’s journey hasn’t been without turbulence. The volatile nature of the cryptocurrency market has occasionally threatened its peg stability, necessitating swift interventions by the AMOs. Additionally, active community governance, while empowering, can lead to heated debates and complex proposals, demanding careful navigation.

How Does Frax Work?

Minting Frax involves two components: collateral and FXS tokens. Users deposit a portion of collateral (usually USDC) and some FXS. If FXS is above $1, less collateral is needed. This triggers the system to mint new FRAX tokens. Conversely, redeeming FRAX for its underlying assets burns a proportional amount of FXS, balancing supply and demand. This mechanism incentivizes both collateral providers and FXS holders, aiming for a stable FRAX price.

What Are The Primary Features of The Frax Ecosystem?

Frax offers various ways to earn rewards and leverage its ecosystem through:

Liquidity Pools: Providing liquidity to specific Frax-based pools on platforms like Uniswap earns you FXS tokens as a reward. These pools typically pair Frax with other stablecoins or assets, incentivizing market stability and providing trading opportunities6.

Rewards and Staking: You can directly stake your Frax tokens or specific pool tokens in dedicated contracts on Frax’s platform. This locks your tokens for a set period, earning you additional FXS rewards based on your stake size and the chosen pool. The longer you lock your tokens, the higher the potential rewards.

FXS Token Utility: Holding FXS grants you the right to vote on key protocol decisions, shaping Frax’s future. Additionally, FXS plays a crucial role in the algorithmic mechanism, potentially earning you further rewards through seigniorage, the process of creating new FRAX tokens and distributing them proportionally to FXS holders.

What Are The Tokenomics Of Frax Share (FXS)?

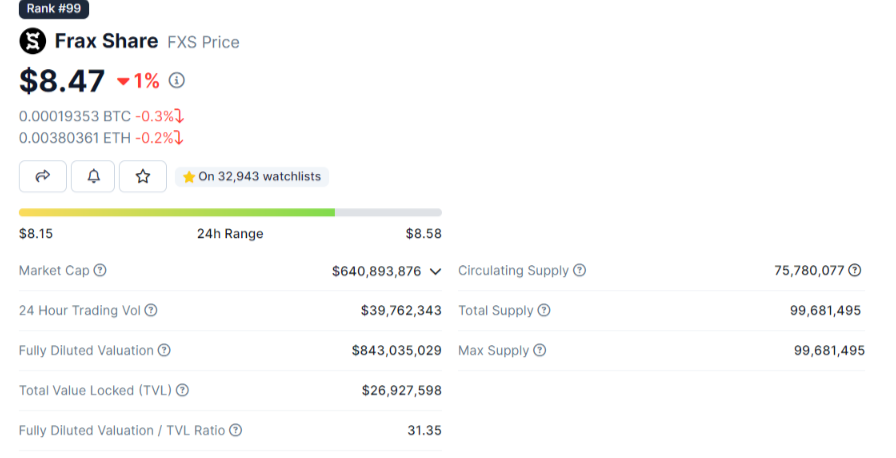

FXS has a maximum supply of 99.6 million and 75.7 in circulating supply as of December 2023 according to data from CoinGecko. The token has various DeFi use cases and plays a role in the network’s governance. It has a market capitalization of $640 million, placing it just in the top 100 cryptos.

How Has Frax Share (FXS) Traded In 2023, And What Is The FXS Price Prediction?

Frax Share (FXS) has rallied by over 105% in the last year, which has pushed its price above $8 for the first time in around six months. Despite the 2023 FXS is down 37% in the past five years.

CoinCodex7 has issued a bullish short and long-term forecast for FXS. They’ve set a maximum price target of $20 for 2024 and $68 for 2025.

Changelly8 has forecast modest returns of between 5-10% for FXS in 2024. They suspect that 2025 will see FXS surge to well above $10 and reach $20 in 2026.

Remember that crypto prices are extremely volatile, and you should always do your own research before risking your capital. Nothing in this post should be considered as financial advice.

Final Thoughts on Frax

Frax is a successful stablecoin protocol that has managed to maintain its peg to the USD even during times of market volatility. Beyond offering a 1:1 USD crypto, the platform has grown into a DeFi ecosystem with lending, borrowing and swapping features. The FXS multi-utility token plays a role in the stablecoins function and offers users governance options, it has rallied by over 100% this year and its market capitalization appears to moving toward $700 million.

Frequently Asked Questions

What Is Frax?

Frax (FRAX) is a crypto stablecoin designed to maintain a 1:1 peg to the US dollar. Unlike traditional stablecoins backed by reserves, Frax uses a unique dual-token system with FRAX and FXS. FRAX acts as the stablecoin for everyday use, while FXS is a governance token that captures upside potential and absorbs price fluctuations. This system aims to provide greater flexibility and stability compared to traditional methods. Here’s the gist:

How does the FRAX stablecoin maintain its stability?

The FRAX stablecoin maintains its stability through a fractional-algorithmic stability mechanism. This mechanism works by using a combination of collateralization and algorithmic stabilization. It is designed to keep the value of the FRAX stablecoin close to the value of the US dollar. The algorithmic aspect of the mechanism adjusts the supply of FRAX in circulation to maintain its price stability.

What assets are used to collateralize the FRAX stablecoin?

The FRAX stablecoin is collateralized by a combination of USDC, USDT, and other stablecoins. The collateral assets are held in smart contracts on the Ethereum blockchain. The collateralization ratio is set to 85%, which means that for every 1 FRAX stablecoin in circulation, there is at least 0.85 US dollars worth of collateral backing it.

WRITTEN

Peter Barker

Peter is an experienced crypto content writer and a DeFi enthusiast with more than 3+ years of experience in the space. Previously a journalist and news editor at a leading European news sourcing agency.