What Are DeFi Yield Aggregators?

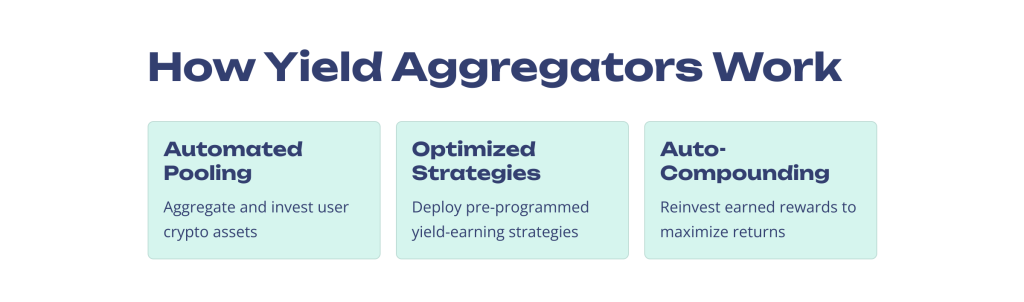

Yield farming is a concept that has emerged in the DeFi industry, which involves locking up cryptocurrencies to generate rewards. A DeFi yield aggregator is a type of smart contract that automatically pools investors’ crypto assets and invests them in a portfolio of yield-paying products and services through pre-programmed strategies. Yield aggregators are also known as “auto-compounders” or “yield optimizers” and are a crucial component of the yield economy.

Key Takeaways

- DeFi is a rapidly growing branch of the cryptocurrency industry that challenges the limitations of the traditional financial system.

- Yield farming is a concept that has emerged in the DeFi industry, which involves locking up cryptocurrencies to generate rewards.

- Yield aggregators are platforms that pool investors’ crypto assets and invest them in a portfolio of yield-paying products and services through pre-programmed and automated smart contracts.

How Does Yield Farming Work?

Yield farming is a popular DeFi field that allows investors to earn rewards by moving their tokens to yield-generating smart contracts. In this process, investors act as liquidity providers (LPs), and the liquidity pool is a cash-filled smart contract.

Automated market makers (AMMs) are also critical components of yield farming, enabling users to trade through an automated system via liquidity pools instead of traditional buyer and seller markets.

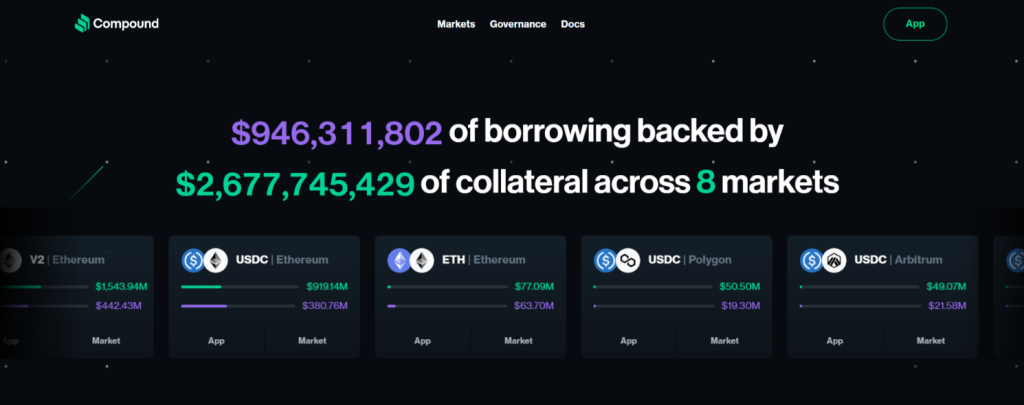

The concept of yield farming gained popularity with the creation of COMP, the governance token of the DeFi lending protocol Compound. This protocol rewards users with newly-minted COMP tokens when they use lending and borrowing services, a process known as “liquidity mining.”

In addition to earning interest when lending and fees when providing liquidity, yield farming participants can earn governance tokens, incentivizing early adoption of the platform. These various rewards in the form of interest, fees, and token distribution laid the foundation for DeFi yield aggregators.

Yield farming has become a popular way for investors to earn passive income in the DeFi space. However, it is important to note that yield farming involves risks, including the possibility of smart contract vulnerabilities, impermanent loss, and market volatility. Investors should carefully consider the risks before participating in yield farming.

How Do Yield Aggregators Work?

Yield aggregators are automated systems that combine the investments of various farmers (crypto investors) to facilitate profit-earning using different strategies while remaining idle and waiting to accumulate passive income. Yield farming typically expects participants to lock up or stake their funds, and yield aggregators automate the farming process to produce the highest yields possible.

What are the leading Yield Strategies?

One popular yield strategy is to provide liquidity to a decentralized exchange (DEX). Liquidity is an essential component of DeFi, and DEXs replace the traditional order book with a liquidity pool where participants provide the crypto assets to be traded. This way, liquidity is good enough to enable instant trades, and LPs can receive a share of the transaction fee in return. However, investors should typically claim these dividends manually and pay a gas fee every time, affecting their profits and lowering their staking annual percentage yield (APY).

Another strategy to get rewards in yield farming is depositing (staking) LP tokens into a farm that will pay participants the rewards in its native LP — or single — tokens. In this case, yield aggregators enable users to automate this process and save on gas fees by staking their LP or single tokens in vaults. They will automatically claim them, convert them into interest-bearing assets and deposit them back into the farm for maximum profit.

The yield aggregator platforms use various yield strategies to optimize returns for investors. Yield strategies include:

- Providing liquidity to a decentralized exchange (DEX)

- Yield farming pools

- Crypto lending

- Ethereum staking

Yield Aggregator Platforms

Most DeFi yield aggregators are deployed on Ethereum, followed by Polygon. Investors should ensure the network chosen for yield optimization is compatible with the blockchain that hosts their assets.

Yearn.finance is one of the top yield aggregators, based on Ethereum and accessible through Fantom and Arbitrum. It’s a versatile platform because it allows users to optimize the yield by combining liquidity pool staking, crypto lending, yield farming pools, and Ethereum staking to produce the optimal APY rate for staking crypto assets.

Harvest Finance is an automated yield farming protocol that offers a yield with compounding interest through its farm liquidity mining program. It is easy for beginners and non-techie investors who want the highest passive income, as it automates the collection of capital from different yield farmers, saving money and time for participants.

In conclusion, yield aggregators are automated systems that combine the investments of various farmers to facilitate profit-earning using different yield strategies. Yield aggregators automate the farming process to produce the highest yields possible and enable users to automate the staking, collecting, and re-investing of generated profits.

Yield aggregator platforms use various yield strategies to optimize returns for investors. Investors should ensure the network chosen for yield optimization is compatible with the blockchain that hosts their assets.

| Platform | Chains | Assets | Features | Pros | Cons |

|---|---|---|---|---|---|

| Yearn | Ethereum | Diverse | Lending, Vaults, Auto-compounding | Proven, Large community, Extensive integrations | High gas fees, Complex interface |

| Ape | Polygon | Stablecoins, DeFi tokens | Lending, Yield farming, Auto-compounding | High APYs, Gamified, Simple interface | Limited assets, Smaller community |

| Harvest Finance | Ethereum, Polygon, Avalanche | Diverse | Lending, Borrowing, Vaults, Auto-compounding | Multi-chain, Risk management tools | Lower returns compared to others, Less intuitive |

| Tulip Protocol | Solana | Stablecoins, DeFi tokens, Solana native | Lending, Liquidity providing, Auto-compounding | Fast transactions, Cross-margin farming | Newer platform, Smaller ecosystem |

DeFi Yield Farming and Aggregator Risks: A Quick Guide

DeFi yield aggregators have become a popular tool among crypto investors to earn passive income. However, like any investment, yield farming carries risks. Yield farming strategies involve different protocol layers, which could facilitate the proliferation of scams and bugs, leading to a zero token price.

- Protocol Scams & Bugs: Underlying protocols could be vulnerable to scams or bugs, leading to token value loss.

- Impermanent Loss: Price changes in underlying assets can reduce returns through impermanent loss.

- Liquidation Risk: Borrowing with asset collateral can lead to liquidation if the collateral’s value falls1.

Higher Risks for Small Investors:

- Large investors may manipulate prices and are less likely to face liquidation.

Risk Mitigation:

- Audit platform and protocols.

- Monitor asset performance.

- Invest responsibly and diversify.

- Follow security best practices.

Key Takeaway:

Yield aggregators offer potential returns but involve inherent risks. Invest cautiously and only with what you can afford to lose.

| Risk | Description | Mitigation |

|---|---|---|

| Protocol Scams & Bugs | Underlying protocols could be attacked, leading to token value loss. | Audit platform and protocols. |

| Impermanent Loss | Price changes in underlying assets can reduce returns. | Monitor asset performance and be prepared to adjust investments. |

| Liquidation Risk | Borrowing with asset collateral can lead to liquidation if the collateral’s value falls. | Invest responsibly and avoid over-leveraging. |

Final Thoughts on DeFi Yield Aggregators

In conclusion, DeFi yield aggregators have emerged as innovative solutions, streamlining access to decentralized finance opportunities. Their role in optimizing yield generation across multiple protocols is undeniable, offering users a convenient way to maximize returns. However, potential risks such as smart contract vulnerabilities and market volatility should be acknowledged.

Frequently Asked Questions

-

What are DeFi yield aggregators?

DeFi yield aggregators are platforms that combine DeFi protocols, automating investments across lending, borrowing, and liquidity pools to maximize returns for crypto holders. Imagine them as Robo-advisors for DeFi, streamlining the process and potentially boosting gains but still carrying inherent risks.

-

How do yield aggregators optimize returns for investors in the DeFi space?

Yield aggregators optimize returns for investors in the DeFi space by automating the process of yield farming. Yield farming is the process of lending or staking cryptocurrencies on DeFi platforms to earn rewards. Yield aggregators use different strategies to move tokens across multiple platforms to maximize returns for investors. These strategies include auto-compounding, which involves reinvesting the rewards earned from staking to earn more rewards. Yield aggregators also optimize gas fees by automating the process of staking and collecting rewards, reducing the cost of transactions.

-

What strategies do yield aggregators employ to enhance earnings from liquidity pools?

Yield aggregators employ various strategies to enhance earnings from liquidity pools. One such strategy is auto-compounding, which involves reinvesting the rewards earned from staking to earn more rewards. Another strategy is yield optimization, which involves moving tokens across different platforms to maximize returns for investors. Yield aggregators also use smart contract technology to automate the process of staking and collecting rewards, reducing the cost of transactions.

WRITTEN

Peter Barker

Peter is an experienced crypto content writer and a DeFi enthusiast with more than 3+ years of experience in the space. Previously a journalist and news editor at a leading European news sourcing agency.