What Is Ondo Finance?

Ondo Finance is a decentralized finance (DeFi) protocol that enables users to invest in a variety of DeFi products linked to real-world assets (RWA) and instruments. The protocol also offers a yield farming program that allows users to earn rewards by providing liquidity to the protocol. Ondo Finance is a promising new DeFi project with the potential to revolutionize the way people invest in decentralized finance. The protocol’s focus on DeFi and interest-earning tools makes it a compelling option for both retail and institutional investors. The project’s native ONDO token went live in January 2024 and quickly saw its market capitalization grow above $300 million.

Key Takeaways

- Ondo Finance is a decentralized finance (DeFi) protocol that allows investors to gain exposure to these assets in a more liquid and accessible way.

- Ondo Finance’s flagship product, USDY, is a tokenized secured note that offers investors yield from a basket of assets, including short-term US Treasuries and bank deposits.

- Ondo Finance works with Flux Finance to provide lending and borrowing options across a range of assets and stablecoins.

- The ONDO token went live in January 2024, offering governance use cases within the Ondo DAO and Flux Finance.

What Is The History of Ondo Finance?

Ondo Finance was founded in 2022 by a team of experienced professionals from Goldman Sachs1, Bridgewater Associates, Millennium Management, and MakerDAO. The company is backed by leading investors, including Founders Fund, Coinbase, and Pantera Capital, and it raised $20 million in 20222.

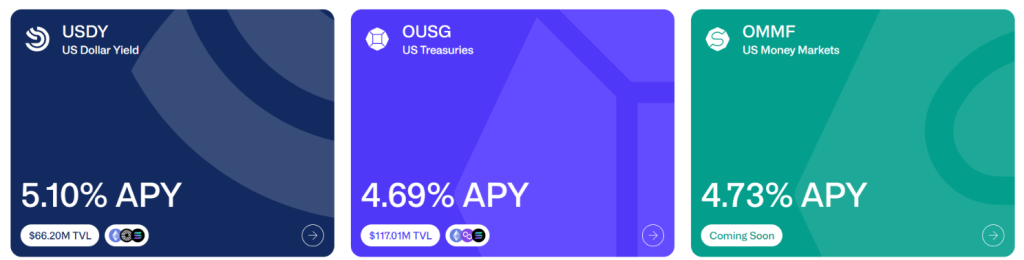

The company’s mission is to build the next generation of financial infrastructure to improve market efficiency, transparency, and accessibility. Ondo Finance offers a variety of products, including USDY, OUSG, and OMMF. USDY is a stablecoin pegged to the US dollar, while OUSG is a tokenized version of the U.S. Treasury’s 10-year Treasury Note. OMMF is a market-maker protocol that provides liquidity to DeFi markets.

Ondo Finance has a number of milestones to its credit, including the launch of USDY in 2022, the launch of OUSG in 2023, and the launch of OMMF in 2024. The company has also raised a significant amount of capital from leading investors.

Ondo Finance is a promising new DeFi project with the potential to revolutionize the way people invest in decentralized finance. The protocol’s focus on DeFi and interest-earning tools makes it a compelling option for both retail and institutional investors.

What Are The DeFi Tools Offered By Ondo Finance?

Ondo Finance is a decentralized finance (DeFi) protocol that enables users to invest in money markets and treasuries. By breaking down these traditionally illiquid assets into smaller, more manageable units, Ondo Finance makes it possible for a wider range of investors to gain exposure to these assets.

Here are the DeFi tools offered by Ondo Finance:

- USDY: A stablecoin pegged to the US dollar. USDY is a decentralized stablecoin that is backed by a basket of assets, including cash and other liquid assets. This makes it a more stable and secure option than other stablecoins that are backed by a single asset, such as Tether (USDT).

- OUSG: A tokenized version of the U.S. Treasury’s 10-year Treasury Note. OUSG is a token that represents ownership of a fraction of a U.S. Treasury bond. This makes it a more liquid and accessible way to invest in U.S. Treasury bonds.

- OMMF (Coming Soon): This instrument will offer liquid exposure to ultra-low-risk U.S. Money Markets, with daily airdropped distributions and a fixed $1 value.

Stablecoins vs. USDY Tokenized Secured Note

One of the most pertinent questions is what makes USDY different from other stablecoins. USDY does not fall under the conventional stablecoin category; rather, it functions as a tokenized secured note3. Similar to stablecoins, USDY functions as a bearer asset, allowing transfer to investors without requiring onboarding with the issuer. A distinctive feature of USDY, setting it apart from stablecoins, is that holders earn a significant portion of the yield generated by the assets backing USDY. The yield is currently just above 5%, according to the Ondo website4.

| Feature | Stablecoins | USDY |

|---|---|---|

| Bankruptcy-remoteness | Generally issued from operating companies, with potential impact on redemption during issuer bankruptcy. | Issued by Ondo USDY LLC, designed to be bankruptcy-remote. |

| Yield | Stablecoin holders receive no direct interest. | USDY holders earn yield from underlying assets, increasing redemption value. |

| Asset Security | Unsecured liabilities at risk of subordination. | USDY holders have a security interest in the assets backing it. |

| Regulatory Compliance | Stablecoins exist in a regulatory gray area. | USDY issued in compliance with US federal and state laws. |

| Oversight | Stablecoin issuers can unilaterally change asset backing. | Ankura Trust Company oversees USDY, enforcing eligibility criteria. |

| Timely Redemptions | Litigation may be necessary for stablecoin redemption delays. | USDY has an Event of Default, triggering liquidation by Ankura Trust. |

Ondo Short-Term US Government Treasuries (OUSG) Explained

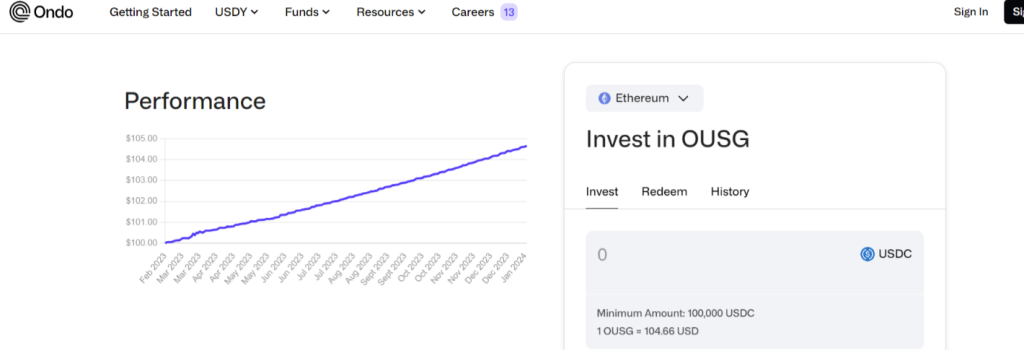

Ondo Short-Term US Government Treasuries (OUSG) is a decentralized finance (DeFi) product that provides exposure to short-term US Treasury bonds5. OUSG is a tokenized version of a US Treasury ETF, which means that each OUSG token represents ownership of a fraction of a US Treasury bond. This makes it a more liquid and accessible way to invest in US Treasury bonds than traditional methods. OUSG is traded on decentralized exchanges (DEXs), and it offers a yield to investors.

Users can trade USDC on Ethereum, Polygon, and Solana for OUSG on the Ondo Finance website. According to data provided by the website OUSG has consistently provided returns to holders growing from $100 to $104 since early 20236.

Ondo US Money Markets (OMMF) Explained

This share class provides a liquid exposure to U.S. Money Markets, renowned for their ultra-low-risk nature and consistent returns, coupled with deep liquidity7. U.S. government money market funds (MMFs) are widely acknowledged for being among the most secure and liquid investment choices, boasting over $5 trillion in managed assets. This makes them an appealing option for investors prioritizing safety, stability, and easy access to funds.

The majority of this portfolio will predominantly consist of a to-be-announced MMF, reflecting the fund’s commitment to the low-risk and high-liquidity characteristics of U.S. Money Markets. Distributions will be provided to token holders on a daily basis through “airdrops,” presented in the form of new tokens. Notably, tokens remain consistently purchasable and redeemable at a fixed value of $1, ensuring stability for investors. The team hasn’t given a specific launch date for this instrument.

How Do USDY, OUSG, and OMMF Compare?

DSY, OUSG, and OMMF are institutional-grade tokenized cash equivalents with distinct audiences and use cases. OUSG provides exposure to short-term Treasuries, while USDY is secured by Tokenized Treasuries and bank deposits.

OMMF is a Tokenized money market fund. OUSG and OMMF represent fund membership, while USDY is an interest-bearing note. OUSG and USDY are total-return instruments, increasing in value over time. OMMF pays interest in additional tokens. OUSG and OMMF are for Qualified Purchasers globally, USDY is for non-US investors.

| Feature | OUSG | OMMF | USDY |

|---|---|---|---|

| Collateral | Short-term US Treasuries (SHV) | US government money market funds | Short-term US Treasuries, bank deposits |

| Returns | Tracks BlackRock’s SHV ETF, minus fees | Tracks undisclosed MMF, minus fees. Price pegged to $1 | Variable rate by Ondo Finance; no principal volatility |

| Investor Geography* | Global (US and non-US) | Global (US and non-US) | Non-US |

| Investor Qualification | Institutional (Qualified Purchasers) | Institutional (Qualified Purchasers) | Retail and institutional |

| Issuer | Ondo I LP | Ondo I LP | Ondo USDY LLC |

| Legal Structure | Limited partnership interest | Limited partnership interest | Senior secured loan |

What Is Flux Finance, and How Is It Linked To Ondo Finance?

Flux Finance allows users to lend and borrow stablecoins against tokenized US treasuries. Ondo Finance provides liquidity to Flux Finance’s market maker protocol. This ensures that there is always enough liquidity available for users to trade and lend permissioned assets.

Here are some of the specific benefits of using Flux Finance:

- Fractionalization and tokenization: Flux Finance uses a unique technology called “permissioned tokenization” to fractionalize and tokenize permissioned assets. This makes it easier for investors to buy and sell these assets, which can improve their liquidity.

- Collateralized lending: Flux Finance allows investors to lend their permissioned assets to borrowers in exchange for interest payments. This can be a profitable way to earn income on these assets.

- Seamless cross-chain compatibility: Flux Finance is built on the Flux Network, which is a multi-chain blockchain platform. This means that the platform can support permissioned assets from multiple different blockchains.

What Is the ONDO Token? What Are Its Use Cases?

The ONDO token was listed on several leading centralized and decentralized exchanges, including Binance, OKX, KuCoin, Gate and ByBit, in January 2024. it has a maximum supply of 10 billion, according to CoinGecko8, and a market capitalization of around $380 billion as of writing. The primary use cases of ONDO are for governance within Flux Finance and Ondo DAO9, where holders can use it to vote on proposals related to the platform’s development10.

The Ondo Foundation appears to be aiming for a more decentralized model that uses ONDO for new ventures and democratic management11. Although the token has only been trading for a few days, its price has experienced an impressive surge, and its market cap is already in the top 160.

Final Thoughts on Ondo Finance, ONDO, and Flux

Ondo Finance is a promising decentralized finance (DeFi) project that has developed two live DeFi products: USDY, a tokenized secured note that offers investors yield from a basket of assets, including short-term US Treasuries and bank deposits, and OUSG, a tokenized version of the U.S. Treasury’s 10-year Treasury Note. The company is also preparing to launch its third product, OMMF, a market-maker protocol.

As of today, Ondo Finance has accumulated over $100 million in total value locked (TVL), indicating strong interest from investors. Flux Finance, a closely linked project, recently saw the launch of the native ONDO token, which has quickly grown to a $380 million market cap, and data from DeFi Lama12 shows a massive spike in its TVL.

Frequently Asked Questions

What is Ondo Finance?

Ondo Finance is a decentralized finance protocol that provides institutional-grade access to real-world assets (RWAs) through fractionalization and tokenization. It aims to democratize access to various real-world yield-earning instruments, such as government-issued treasuries.

What Are The Currently Available Ondo DeFi Tools?

Ondo Finance offers a suite of tools that allow investors to access and manage RWAs:

USDY: USDY is a tokenized secured note that offers investors yield from a basket of assets, including short-term US Treasuries and bank deposits.

OUSG: OUSG is a tokenized version of the U.S. Treasury’s 10-year Treasury Note.

What Are The Benefits of Ondo Finance?

Ondo Finance offers several key benefits to investors:

Access to new asset classes: Ondo Finance allows investors to access new asset classes that are not currently available on traditional exchanges.

Improved liquidity: Fractionalization and tokenization make RWAs more liquid and accessible to a wider range of investors.

Enhanced diversification: Ondo Finance allows investors to diversify their portfolios by investing in a wider range of RWAs.

WRITTEN

Peter Barker

Peter is an experienced crypto content writer and a DeFi enthusiast with more than 3+ years of experience in the space. Previously a journalist and news editor at a leading European news sourcing agency.