With the recent launch of the first US-based Bitcoin Exchange-Traded Funds (ETFs) and the upcoming BTC halving, crypto activity is on the rise again. Consequently, market players have new opportunities to trade, invest, stake, lend, and gain exposure to cryptocurrencies in other ways.

However, the proceeds of these activities are considered taxable income or gains in most jurisdictions, meaning that you must pay crypto taxes after them. Due to the unique nature of blockchain technology and the complexities of local regulations, calculating and reporting your tax liabilities on your own as a cryptocurrency business or a retail investor is often a challenging task.

This is where crypto tax software can help. With the right tool, you can track your digital asset activities, categorize your transactions, as well as calculate and file your taxes without hassle.

But what is the best crypto tax software to remain compliant in 2024? In this guide, we have collected the top cryptocurrency tax tools, carefully reviewing each based on multiple factors to help you with decision-making.

Here’s a summary of the best crypto tax software solutions that are available on the market at the moment:

| CoinLedger | Koinly | CoinTracker | TokenTax | ZenLedger |

|---|---|---|---|---|

|  |  |  | |

| Best For: Value For Money | Best For: Integrations | Best For: Features | Best For: Professional Tax Filing | Best For: Unlimited Transactions |

| Coverage: 50+ Countries | Coverage: 100+ Countries | Coverage: 100+ Countries | Coverage: Global | Coverage: Global |

| Integrations: 100+ | Integrations: 700+ | Integrations: 500+ | Integrations: 120 | Integrations: 550+ |

| Pricing: $49- $199+/year | Pricing: $49-$279+/year | Pricing: $59-$1,999/year | Pricing: $65-$2,999/year | Pricing: $49-$999/year |

| Free Trial/Tier: Yes | Free Trial/Tier: Yes | Free Trial/Tier: Yes | Free Trial/Tier: Yes | Free Trial/Tier: Yes |

| Learn More | Learn More | Learn More | Learn More | Learn More |

What Is A Crypto Tax Software?

A crypto tax software is a service that helps individuals and enterprises streamline their cryptocurrency taxes while staying compliant with regulatory laws.

To achieve the above goal, the crypto tax software tracks your transactions across various wallets, exchange accounts, decentralized applications (dApps), and blockchains. These can include transfers related to:

- Buying and selling digital assets

- Crypto mining and staking

- Trading

- Lending

- Yield farming, decentralized exchange (DEX) swaps, and other decentralized finance (DeFi) activity

- NFT trades

- Airdrops

- Receiving cryptocurrency in exchange for selling products and services

- Token generation events (TGEs) and token sales

After connecting your wallets and accounts to the software, the crypto tax tool helps you categorize these transactions (e.g., through automatic classification) and calculate your cost basis, revenue, and taxes related to your cryptocurrency activity. Based on this data, it generates a tax report for you, which enables you to file your taxes in your jurisdiction in a compliant manner. Optionally, you can provide access to the software for your accountant so they can file your taxes on your behalf.

Most cryptocurrency tax software solutions offer features that can help you identify opportunities to optimize your crypto taxes. For example, tax-loss harvesting can decrease your tax liability by selling some of your digital assets at a loss to offset other capital gains.

The 5 Best Crypto Tax Software Solutions Reviewed For 2024

In this section, we have collected the 5 best crypto tax software solutions that will help you stay compliant in 2024 and beyond. Each subsection includes a comprehensive review of each tool based on different factors, including:

- Availability

- Key features

- Pricing

- Integrations

- Free tier or trial

Ready to learn which solutions we picked as the best crypto tax software for 2024? Let’s get started, then!

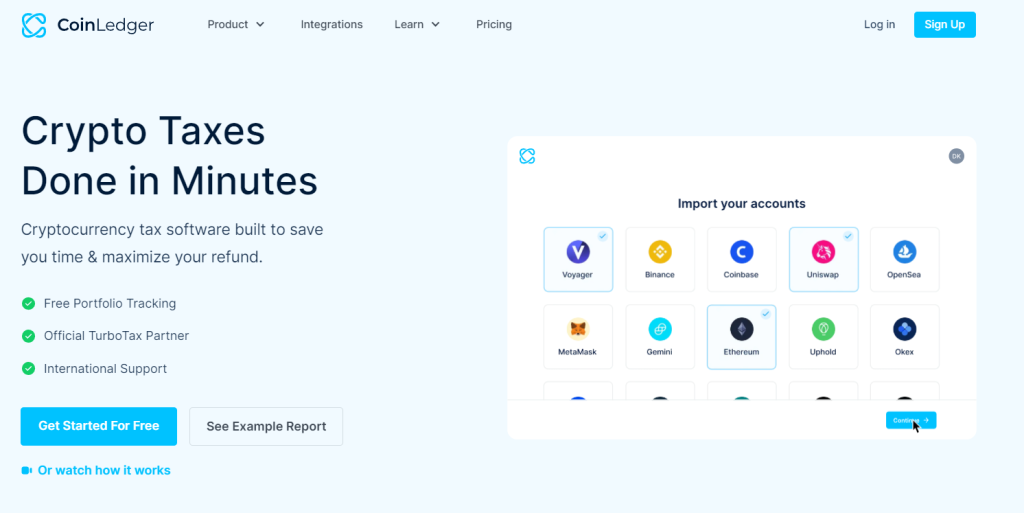

1. CoinLedger: Best Value For Money

CoinLedger

The best value for money

Geographical Coverage

50+ Countries

CoinLedger is among the most popular crypto tax software solutions. Formerly known as CryptoTrader.Tax, the company was founded in 2018 by David Kemmerer, Lucas Wyland, and Mitchell Cookson. When the trio was building automated crypto arbitrage trading systems, they realized how difficult it was to report cryptocurrency transactions, and that’s how CoinLedger came to life.

Now, CoinLedger is Trusted by over 500,000 digital asset investors, who are utilizing the crypto tax software to streamline their cryptocurrency taxes. To date, the company has processed $70 billion in transactions and saved its clients $50 million via tax-loss harvesting.

Review

Integrations

100+

Pricing

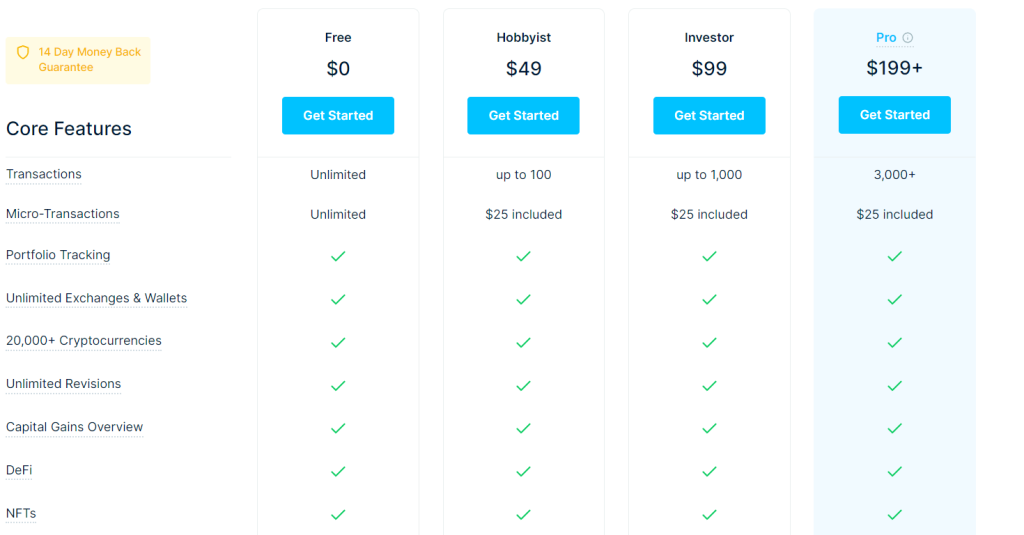

$49-$199+/year

Free Trial/Tier

Yes

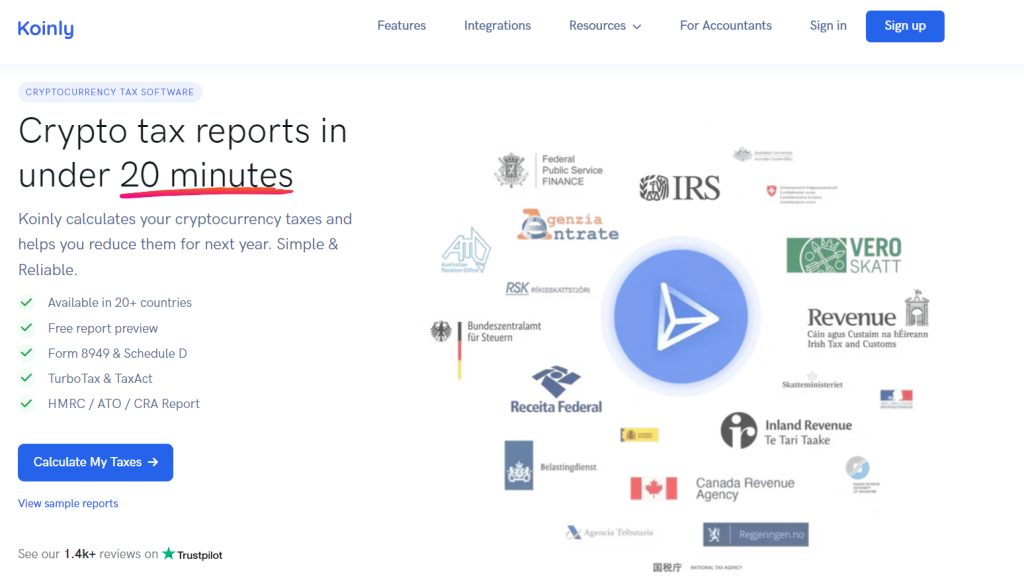

2. Koinly: Best For Integrations

Koinly

The best for integrations

Geographical Coverage

100+ Countries

Review

Integrations

700+

Pricing

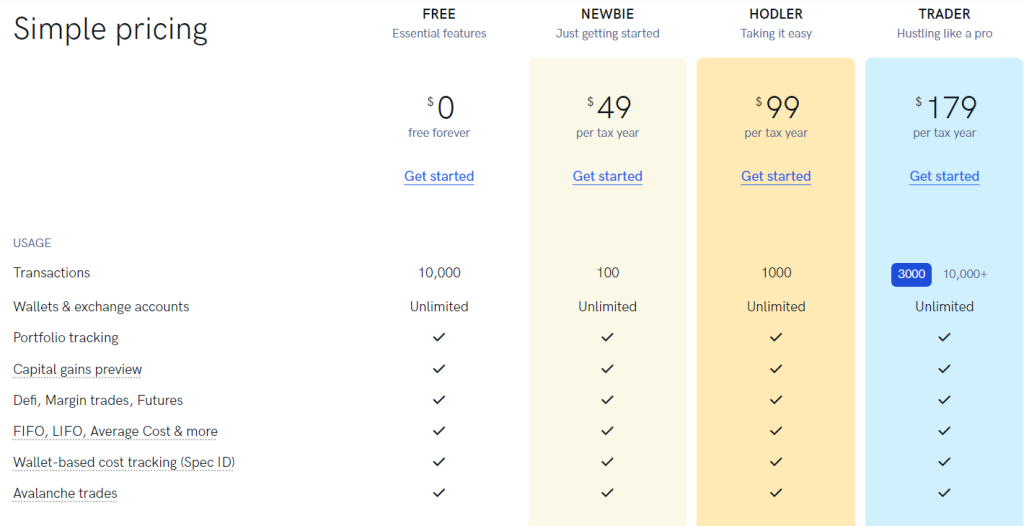

$49-$279+/year

Free Trial/Tier

Yes

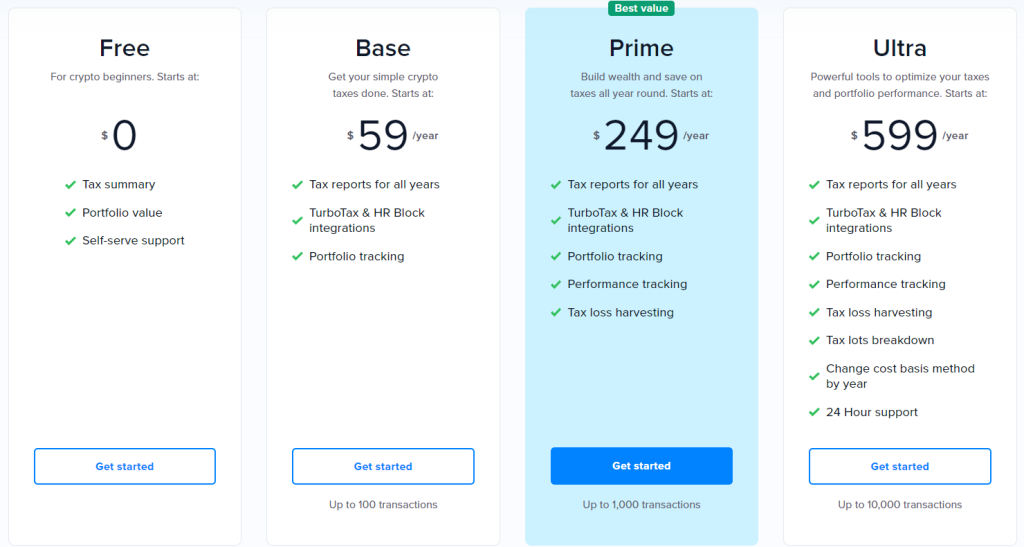

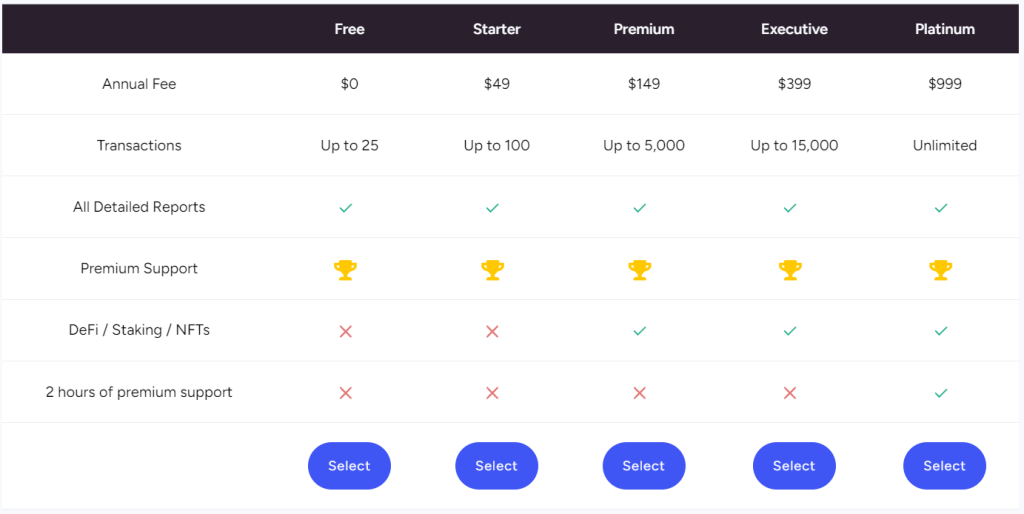

3. CoinTracker: Best For Features

CoinTracker

The best for features

Geographical Coverage

100+ Countries

Trusted by over 2 million cryptocurrency users, CoinTracker is among the best crypto tax software solutions that are currently available on the market.

Founded in 2017 by Chandan Lodha and Jon Lerner, CoinTracker currently tracks 5% of the combined crypto market capitalization with $50 billion of tracked digital assets. Moreover, the company raised $100 million of Series A funding in January 2022 and is backed by prominent VCs like Coinbase Ventures, Kraken Ventures, Intuit Ventures, and Y Combinator.

Review

Integrations

500+

Pricing

$59-$1,999/year

Free Trial/Tier

Yes

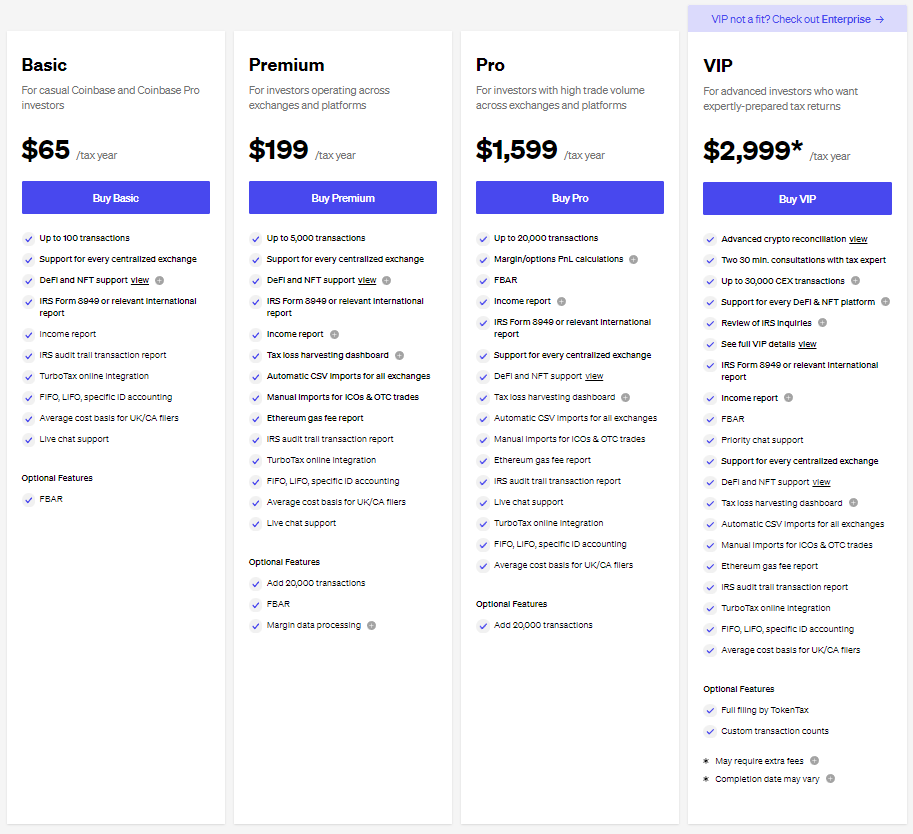

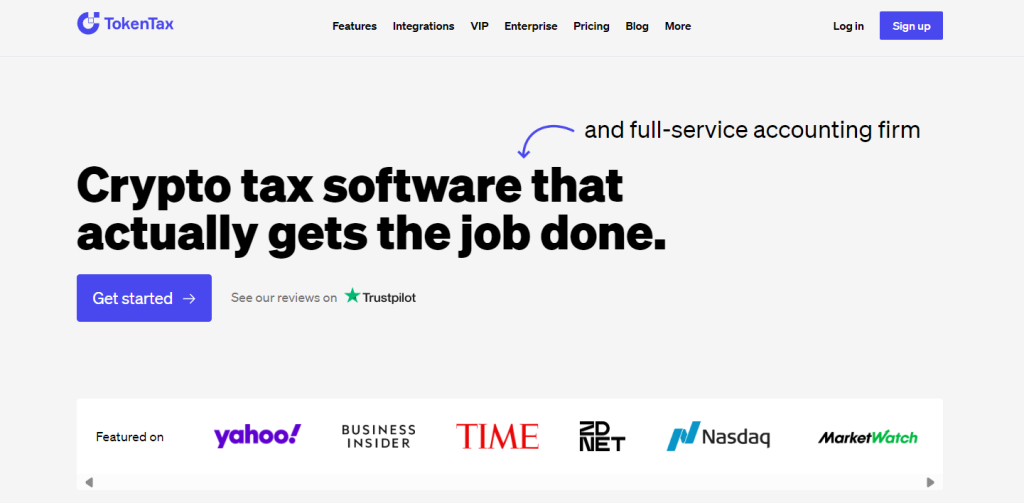

4. TokenTax: Best For Professional Tax Filing

TokenTax

The best for professional tax filing

Geographical Coverage

Global

In this guide, we have included TokenTax among the best crypto tax software solutions for a valid reason. Founded in 2017 by Alex Miles and Zac McClure, the company has a solid reputation and an established market history that combines the functionality of a cryptocurrency tax tool with the expertise of TokenTax’s tax professionals.

Review

Integrations

120

Pricing

$65-$2,999/year

Free Trial/Tier

Yes

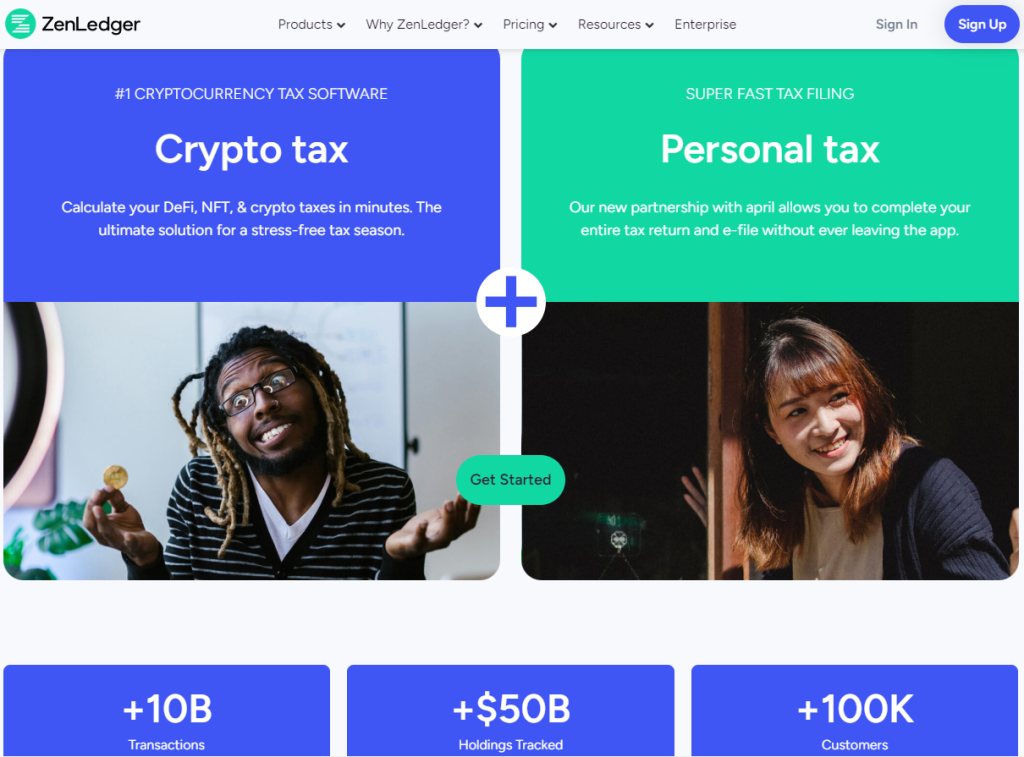

5. ZenLedger: Best For Unlimited Transactions

ZenLedger

The best for unlimited transactions

Geographical Coverage

Global

Review

Integrations

550+

Pricing

$49-$999/year

Free Trial/Tier

Yes

How To Choose The Best Crypto Tax Software?

To choose the best crypto tax software, you must consider numerous qualities to make the right choice. In the table below, we have selected the top five factors to help you in making up your mind:

| Factor | Description | Crypto Tax Software Recommendations |

|---|---|---|

| Geographical Coverage | It is crucial for a crypto tax software solution to be compatible with the country of your residence. This way, you can ensure that you can calculate and file your taxes in a compliant manner. | Koinly, CoinTracker, TokenTax, ZenLedger |

| Features | Standout features can make it more efficient, convenient, or faster to report and file your crypto taxes. Moreover, functionality like tax-loss harvesting can even save you money on your tax bill by identifying opportunities to optimize your taxes. | CoinLedger, Koinly, CoinTracker |

| Integrations | The more integrations a cryptocurrency tax software has, the better the chances that it is able to track the transactions of your wallets, exchange accounts, DeFi protocols, and NFT marketplaces. | Koinly, CoinTracker, ZenLedger |

| Pricing | High price tags may discourage some from utilizing a crypto tax tool. On the other hand, reasonable pricing could save you money on both your tax bill and cryptocurrency tax software subscription. | CoinLedger, Koinly, ZenLedger |

| Free Trial/Tier | A free trial or plan is necessary to see how a crypto tax software solution works in practice. At the same time, it could also offer a way for casual cryptocurrency users with a small number of transactions to file their taxes without subscribing to higher tiers. | CoinLedger, Koinly, CoinTracker, TokenTax, ZenLedger |

Final Thoughts

Cryptocurrency tax tools help you track, calculate, and report the taxes on your digital asset transactions while staying compliant with the regulations in your jurisdiction.

In this guide, we have collected and reviewed the top solutions for filing your crypto taxes. Consequently, you can select the cryptocurrency tax software that best fits your needs and preferences. As a recap, we have collected the top services in the below list:

- CoinLedger: The crypto tax software with the best value for money

- Koinly: The best crypto tax software for integrations

- CoinTracker: The best crypto tax software for features

- TokenTax: The best crypto tax software for professional tax filing

- ZenLedger: The best crypto tax software for unlimited transactions

Crypto Tax Software FAQs

What Is The Best Crypto Tax Software?

The best crypto tax software is a tool that is tailored to your needs and effectively helps you fulfill your goals.

Here are the best crypto tax tools based on various preferences:

– Coverage: ZenLedger

– Features: CoinTracker

– Integrations: Koinly

– Pricing: CoinLedger

– Free Tier: CoinLedger

Why Do I Need A Crypto Tax Software?

A crypto tax software is necessary to navigate the landscape and streamline the process in which you calculate and report taxes on your digital asset activities.

Without a crypto tax tool, you would need to manually track and categorize your cryptocurrency transactions that took place in the current tax year. You would also need to calculate the cost basis of these transactions to determine your capital gains and losses. After that, you or your accountant would have to file your annual tax returns.

Filing your taxes would present little to no problems in a traditional environment where you have access to bank statements that summarize all your activity on your accounts at a financial institution. But in the cryptocurrency world, this process becomes much more complex as your transactions are scattered across numerous wallets, exchange accounts, DeFi protocols, NFT marketplaces, and blockchains.

Manually hunting them down, categorizing them, and calculating your crypto taxes can easily become a formidable task, which leaves much room for human error. And to avoid potential fines and penalties, it is crucial to ensure that your tax filings are error-free and reflect reality.

On the other hand, by connecting your addresses to the platform, a cryptocurrency tax software solution automatically tracks and categorizes your digital asset transactions across various wallets, exchange accounts, marketplaces, protocols, and blockchains.

Upon ensuring that everything is in the right place, the tool can use this data to calculate your digital asset taxes, identify opportunities to decrease your tax liability, and generate tax reports.

How Are Cryptocurrencies Taxed?

Crypto tax laws vary by jurisdiction. But, as a rule of thumb, you must pay income taxes on the revenue you generate through various cryptocurrency activities minus deductible expenses.

Such endeavors include receiving payments for products or services in digital assets as a sole proprietor, generating income as a business, mining and staking crypto, participating in airdrops, as well as other ways you can earn coins as both an individual and an organization.

After calculating this income and deducting its respective expenses, you must file your income taxes on your annual tax returns.

Besides income taxes, you also become liable for capital gains taxes (CGT) if you generate a profit from the disposal of digital assets. CGT is calculated by subtracting the cost basis (the original price you paid for an asset plus any commissions and fees related to the transaction) from the price you sold the asset. If the result is negative, you incur a capital loss, which is not liable to taxes.

On the other hand, if your capital gains are higher than your capital losses in a tax year, then you are liable to CGT, which you must report and file with your jurisdiction’s tax authorities.

How To File Crypto Taxes In The US And The UK?

You must report and file crypto taxes both on the revenue and capital gains that are related to digital asset activity.

In the US, you can file your crypto income taxes by reporting it as ordinary income on Form 1040 Schedule 1 or as earnings related to self-employment or your business via Form 1040 Schedule C. In the UK, you must report this income as part of your Self Assessment Tax Return (SA100).

To file your crypto capital gains taxes (CGT), you must fill out and submit Form 8949 and Form 1040 Schedule D to the IRS in the US or declare your capital gains or losses in the Self Assessment: Capital Gains Summary (SA108) in the UK.

How To Claim Crypto Losses On Taxes?

In many jurisdictions, you can offset your other taxable capital gains by selling (a part of) your cryptocurrency holdings at a loss. Let’s see an example to better understand this process.

Suppose Alice is a US-based investor and sells Ether (ETH) at a loss during 2023’s bear market, resulting in $30,000 of capital losses. But she also made another trade by buying Bitcoin (BTC) at the dip and disposing of her stash by the end of the year when its price had increased significantly due to news about BTC ETFs. This trade incurs $50,000 of capital losses.

As both were short-term capital gains/losses, Alice can use her ETH trade’s $30,000 of capital losses to offset her BTC investment’s $50,000 of capital gains. After subtracting the losses from the gain, she is only liable to $20,000 of CGT.

Currently, as most cryptocurrencies are classified as property in the nation, US investors can technically sell their digital assets at a loss during market dips and repurchase the same assets in another trade to offset their capital gains.

However, it is a risky strategy, as it is very likely that the government and financial watchdogs will implement the same wash sale rules for cryptocurrencies as for securities in the future to prevent taxpayers from claiming artificial losses.

Is Crypto Tax Software Free?

Many crypto tax software solutions operate on a freemium model. As a result, a basic version of the service with limited features is offered to customers for free.

Examples of such may include a restricted number of transactions, exchange and wallet integrations, tax report functionality, automatization, portfolio tracking, and more. This free version could be a good fit for those who only had a few crypto transactions in a year and are satisfied with limited platform functionality.

At the same time, the same service providers offer crypto tax software with extended functionality for a price, usually covered as a one-time purchase per tax year. This is a suitable option for those with a considerable number of cryptocurrency transactions and who’d like to enjoy the full experience while calculating and reporting their taxes.

WRITTEN

Benjamin Vitaris

Seasoned crypto, DeFi, NFT and overall web3 content writer with 9+ years of experience. Published in Forbes, Entrepreneur, VentureBeat, IBTimes, CoinTelegraph and Hackernoon.