Ethereum (ETH) staking has become a popular activity among crypto users. By locking up your coins, you contribute to the security of the project’s blockchain network by helping validate blocks. In exchange, you receive Ethereum staking rewards in the form of ETH.

In this guide, we will take a deep dive into ETH staking, exploring what it is, how it works, as well as the best platforms to stake Ethereum.

Moreover, the Ethereum staking landscape has gone through significant development in recent months, introducing new ways to stake ETH. This guide will also cover them, including both liquid staking and ETH restaking.

Key Takeaways

- By staking ETH, you can generate a passive income by locking up your coins and helping secure the Ethereum network.

- You can stake Ethereum in multiple ways, including solo staking, pooled staking, liquid staking, restaking, as well as staking via CEXs and Staking-as-a-Service (StaaS) providers.

- Based on our extensive research, the five best platforms to stake ETH are Lido, Nexo, Binance, EigenLayer, and Coinbase.

What Does it Mean to Stake Ethereum (ETH)?

Ethereum staking refers to the process of locking your ETH tokens as collateral for validation. In exchange for helping maintain the ecosystem, you earn rewards as a staker or a validator. For that reason, many have turned to ETH staking to generate a passive income by putting their idle coins to work.

Staking on the Ethereum mainnet has been possible since the Merge, the most significant update in the project’s history. As part of the event, the blockchain transitioned from the energy-intensive and mining-based Proof-of-Work (PoW) consensus mechanism to the power-efficient and staking-based Proof-of-Stake (PoS) algorithm.

With the PoS mechanism, staking has completely replaced mining for validating blocks in the Ethereum ecosystem. This way, validators don’t have to purchase, set up, and maintain expensive physical equipment to secure the blockchain. Instead, each validator must lock 32 ETH in their wallets.

After locking the necessary amount of ETH in their wallets, the validator becomes eligible to validate the blockchain. In every slot, the network randomly selects a validator to create a new block and send it out to the other nodes within the ecosystem. For reference, a new block is created on Ethereum approximately every 12 seconds.

Besides the proposer, the network also randomly chooses a committee of validators who will verify and vote on the validity of the newly proposed block.

If the validator proposing the block was honest and successfully completed their task, they will be rewarded in ETH rewards. However, slashing will occur if the committee discovers malicious activity or the validator fails to perform its obligations. Slashing is a penalty for misbehavior, in which the network imposes a fine on the validator’s staked ETH.

For that reason, when you stake ETH, you don’t just help secure the ecosystem or generate passive income. You also use your Ethereum tokens as collateral to make sure that you act honestly and efficiently when validating blocks.

How To Stake Ethereum

There are many ways you can stake Ethereum. To make things easier, we have collected the most popular methods for staking ETH in this section, summarizing the pros and cons of each in the table below:

| Method | Pros | Cons |

|---|---|---|

| Solo staking as a validator | – Full control over your staking activity – No counterparty risks – No third-party commissions or service fees – Decentralized and non-custodial | – Requires technical knowledge and expertise to operate the validator node – Must deposit a minimum of 32 ETH to start staking Ethereum |

| Staking via a centralized exchange (CEX) | – Easy to get started – No minimum requirements for the amount of staked ETH – The service provider operates the node – Flexible lock-up periods | – Custodial – Less rewards as with solo staking – Slashing risks |

| Staking-as-a-Service (StaaS) | – No need to worry about the technical operation of the hardware – Non-custodial (in some cases) – Easy to get started as a validator | – Custodial (in some cases) – You still have to deposit a minimum of 32 ETH to start staking – Service provider fees |

| Pooled ETH staking | – Convenient – Non-custodial (in most cases) – No need to operate your node by yourself – No need to deposit at least 32 ETH | – Slashing risks – Smart contract risks – Service provider fees |

| ETH liquid staking | – Non-custodial – Easy to get started – No minimum requirements for ETH deposits – Ability to maximize your earnings by putting your LST coins to work via DeFi protocols – No need to operate your own validator node | – Slashing risks – Smart contract-related risks – Using your LST tokens in DeFi protocols comes with increased risks |

| Restaking Ethereum | – Non-custodial – No minimum requirements for the staked ETH amount – Maximize your earnings while helping extend Ethereum’s cryptoeconomic security to other solutions – If combined with liquid staking, you don’t need to operate your own validator node | – Slashing risks (when combined with liquid staking) – Increased risks due to reusing your staked tokens – Risks of smart contract exploits |

1. Solo Staking

Solo staking is the original method for staking ETH. Here, you run your own validator node and deposit all the Ethereum tokens that are needed to propose blocks.

While this method is the most decentralized with the least counterparty risks, it requires technical knowledge to operate your validator node.

Moreover, you must stake a minimum of 32 ETH, which is worth nearly $128,000 as of March 13, 2024. Thus, it requires a significant initial investment that makes solo staking inaccessible for many.

How to Solo Stake Ethereum

To solo stake ETH, you should follow the steps below:

- Install Geth (Ethereum software) and configure it to set up your validator node. Make sure that you meet Geth’s hardware requirements.

- Fund your validator node with 32 ETH.

- Next, your validator node will be activated, which can take up to 24 hours.

- Once your node is activated, you will start earning Ethereum staking rewards each time the network selects you to propose a new block.

- Maintain your node to continue earning rewards and avoid slashing penalties.

2. Staking via a Centralized Exchange (CEX)

One of the easiest ways to get started with staking ETH is through a centralized exchange. Most top CEXs have vast ecosystems, processing over $100 million of transactions every day.

Beside offering trading services to users, they also enable their customers to stake Ethereum without running their own validator nodes. Instead, the service provider operates the node. This way, you can stake as much ETH as you like with flexible lock-up periods and without any minimum requirements.

However, as CEXs are custodial services, the major downside of this method is that you don’t have full control over your funds while staking. Also, as you have to share the rewards with the service provider, APYs are lower at centralized exchanges than with solo staking.

How to Stake ETH via a Centralized Exchange (CEX)

Here’s what you should do to stake ETH via a CEX:

- Register an account at the centralized exchange and verify it.

- Deposit fiat currency, ETH, or another cryptocurrency to the exchange via one of the available payment methods.

- If you deposit an asset other than ETH, you should first convert it to Ethereum tokens via the CEX’s trading page.

- Head to the “Staking” menu of the exchange, select the amount of ETH to stake, and confirm the transaction.

- While some CEXs offer staking services with fixed periods (e.g., your ETH stays locked for seven days), others have flexible terms that allow you to withdraw your coins from your wallet at any time.

- As CEXs are custodial services, make sure to withdraw your Ethereum tokens after you have stopped staking them via the exchange.

3. Staking-as-a-Service (StaaS)

Instead of managing your own node, Staking-as-a-Service (StaaS) solutions handle the technical responsibilities on your behalf. You don’t have to set up, manage, and operate your own validator node, making ETH staking more accessible to a broader audience.

While StaaS rewards are generally higher than with pooled staking and CEXs, the provider takes a cut from your rewards in exchange for providing the service. Also, some staking-as-a-service solutions are custodial, which can increase counterparty risks.

Moreover, while StaaS providers handle the technical tasks, using such services still requires you to stake a minimum of 32 ETH to become a validator and start earning rewards.

How to Stake ETH via a StaaS

You can stake ETH via a Staking-as-a-Service this way:

- Register an account with the StaaS provider or connect your wallet to the service.

- Deposit 32 ETH to the wallet that you will be using to stake ETH through the StaaS solution.

- The StaaS provider will take care of the technical responsibilities and start staking ETH on your behalf.

- You can track your staking activity via a dashboard.

- The StaaS provider will distribute staking rewards minus its commission to your wallet.

4. Pooled Staking

Pooled ETH staking works similarly as Bitcoin (BTC) mining pools. Instead of operating your own validator node and locking up a minimum of 32 ETH by yourself, the participants of the service pool their Ethereum coins together and share the rewards proportional to each user’s contributions.

The solution’s operator uses the tokens in the pool to participate in native ETH staking. Upon receiving rewards for validating blocks within the Ethereum network, the operator distributes them to the pool’s participants based on their initial stake.

The key advantage of pooled staking is that it makes it more accessible to stake ETH. You neither have to worry about the technical operation of the node nor must fulfill the minimum deposit requirements for validators within the Ethereum network.

However, the above benefits come with certain sacrifices. First, you must trust the operator of the pool that it acts honestly when validating blocks on Ethereum. In case it isn’t efficient or involves itself in malicious activity, your staked ETH may be at risk due to the slashing mechanism.

While ETH staking pools charge a fee for maintaining the service, you should also take into account that many of them utilize smart contracts for pooling participants’ funds. On the one hand, they enable users to stake their Ethereum via the service in a non-custodial way. However, unless they have been audited regularly, there is a risk that the contract has a vulnerability that can be exploited by an attacker.

How to Stake Ethereum via a Staking Pool

Follow the below steps to stake Ethereum via a staking pool:

- Deposit ETH tokens to your Ethereum wallet.

- Head to the staking pool’s website or open its app.

- Connect to the staking pool via your Ethereum wallet.

- Select the amount of ETH to stake and confirm the transaction.

- You will start receiving staking rewards on your Ethereum tokens. Please note that the pool’s operator will deduct a fee from the rewards for offering you the service.

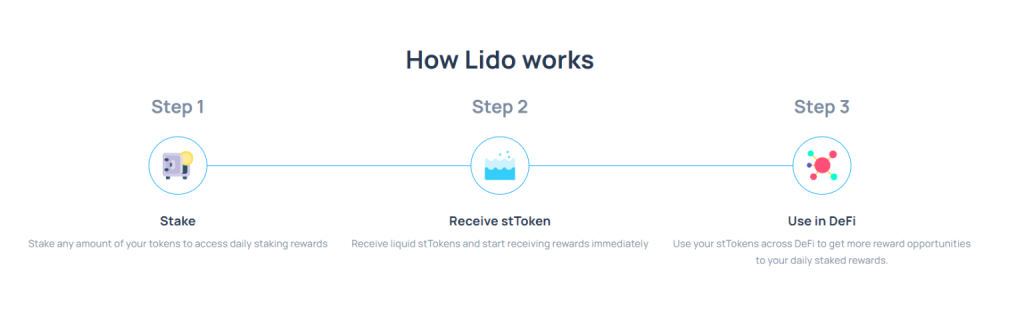

5. Liquid Staking

ETH Liquid staking is a subcategory of pooled Ethereum staking. Instead of simply pooling tokens together to share validator rewards, liquid staking protocols also provide users with a receipt in the form of new assets called liquid staking tokens (LSTs).

LSTs work similarly in nature to liquidity provider (LP) tokens on automated market maker (AMM) protocols like Uniswap, Osmosis, or Orca. You receive a receipt (an LST) representing your staked ETH, which you can redeem at any time for your Ethereum tokens, plus the rewards (or minus the penalties, in case the validator fails to perform its obligations).

And here comes the main benefit of liquid ETH staking. Normally, if you stake Ethereum, the coins you lock up as collateral remain locked in your wallet until you withdraw them from the pool or the CEX. But with liquid staking, you can put your LST to work on decentralized finance (DeFi) protocols through various activities, including borrowing, lending, restaking, trading, yield farming, and more.

Thus, liquid staking unlocks the liquidity of your staked ETH, empowering you with the ability to maximize your rewards through DeFi opportunities. All this while providing the same benefits (no need to worry about the technical side or staking or lock up at least 32 ETH) as staking pools.

Despite accounting for over 60.5% of the $104 billion DeFi market with a $63 billion total value locked (TVL), liquid staking also has potential caveats you should be aware of. Besides the risk of slashing and smart contract exploits, reusing your staked liquidity is riskier than simply leaving your coins locked in your wallet as a validator.

How to Stake ETH via a Liquid Staking Protocol

To get started with liquid staking, follow the below steps:

- Head to the liquid staking protocol’s website and open the app.

- Connect your wallet to the service.

- Head to the “Staking” page and select your preferred amount of ETH.

- Confirm the transaction via your wallet.

- The liquid staking protocol mints LST coins representing your staked ETH.

- Optionally, you can move your LST to other DeFi protocols to earn additional rewards.

- When you believe you have earned sufficient staking rewards, you can redeem your staked ETH through the liquid staking protocol’s “Redeem” page.

- The liquid staking protocol burns your LST and unlocks your ETH.

6. Restaking

With the concept being introduced by EigenLayer, restaking is one of the newest ways to stake ETH. As a new primitive in cryptoeconomic security, restaking refers to the process when you rehypothecate your staked Ethereum on the network’s consensus layer. In practice, this means that:

- You are staking ETH either natively as a validator or via a liquid staking protocol.

- You reuse your staked ETH by opting into a restaking protocol’s smart contracts through a process called restaking.

- On the one hand, restaking ETH extend the Ethereum blockchain’s cryptoeconomic security to solutions that would otherwise couldn’t take advantage of it.

- In exchange for restaking Ethereum, you receive additional rewards, providing an opportunity to maximize your staking earnings.

Without restaking, bridges, data availability layers, as well as blockchains with alternative consensus protocols and chains that rely on their own actively validated systems (AVSs) can’t benefit from Ethereum’s pooled security. But by restaking your ETH, you extend Ethereum’s cryptoeconomic security to these solutions while earning increased staking rewards.

However, restaking comes with its own set of risks. These include delayed withdrawals (EigenLayer has a 7-day delay before you can withdraw your funds), as well as potential risks related to smart contracts and the price fluctuations of liquid staking tokens (LSTs).

How to Restake Ethereum

Here’s how you can restake ETH via a restaking protocol:

- Stake ETH either natively as a validator or via a liquid staking protocol.

- Connect your wallet to the restaking protocol.

- Select the amount of ETH to restake and deposit the required amount of LST coins to the protocol using smart contracts.

- For native restaking, you should utilize a solution like EigenLayer’s EigenPod.

- Monitor your rewards via the dashboard.

- Once you withdraw your coins, be sure to take potential delays into account (such as EigenLayer’s 7-day delay mechanism for withdrawals).

Where To Stake ETH: The 5 Best Platforms

Now that you know how to stake ETH, let’s look at the 5 best platforms for staking Ethereum.

We have conducted extensive market analysis to select the staking platforms in this guide, including a review of each in its respective subsection. Our methodology is based on the following factors:

- Geographical coverage

- Staking APY

- Potential risks

- Security features and audits

- Fees

Here’s a quick look at the 5 best platforms for staking ETH:

| Lido | Nexo | Binance | EigenLayer | Coinbase |

|---|---|---|---|---|

|  |  |  |  |

| Best For: Liquid Staking ETH | Best For: Smart Ethereum Staking | Best For: Staking ETH On A Leading CEX | Best For: Restaking Ethereum | Best For: Staking ETH For US Users |

| Coverage: Global | Coverage: 60+ Countries | Coverage: 100+ Countries | Coverage: Global | Coverage: 100+ Countries |

| ETH Staking APY: 3.6% | ETH Staking APY: 3.5 – 12% | ETH Staking APY: 1 – 2.79% | ETH Staking APY: 3.6% + Restaking APY | ETH Staking APY: 3.19% |

| Staking Fees: 10% | Staking Fees: Included In The APY | Staking Fees: Included In The APY | Staking Fees: TBD | Staking Fees: Included In The APY |

| Security Audit Status: Audited | Security Audit Status: Audited | Security Audit Status: Audited | Security Audit Status: Audited | Security Audit Status: Audited |

| Learn More | Learn More | Learn More | Learn More | Learn More |

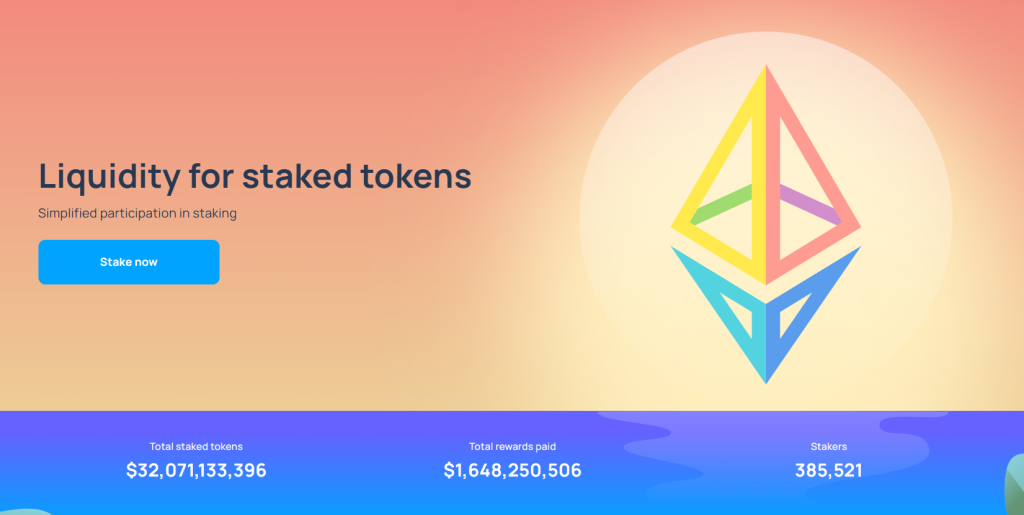

1. Lido: The Best For Liquid Staking ETH

Lido

The best for liquid staking ETH

ETH Staking APY

3.6%

Review

Coverage

Global

Staking Fees

10%

Audit Status

Audited

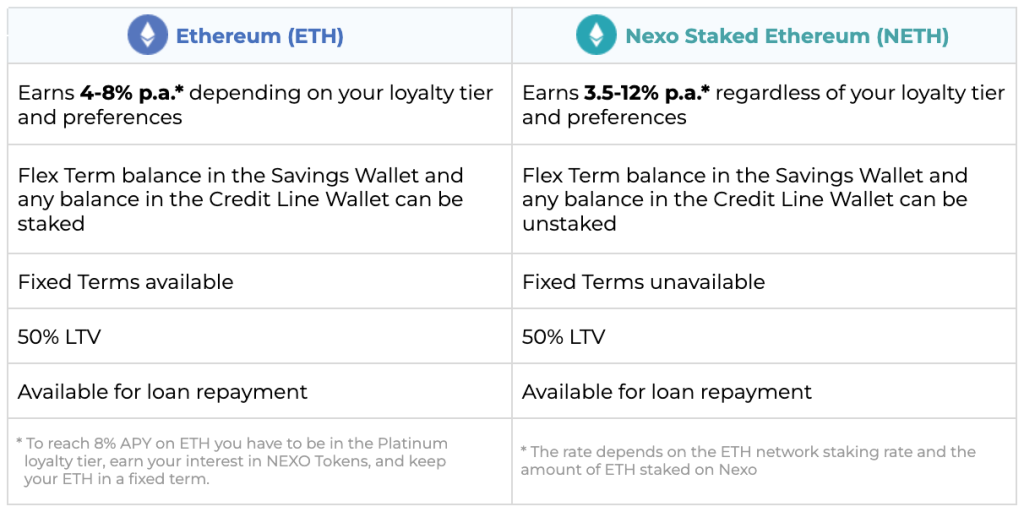

2. Nexo: The Best For Smart Ethereum Staking

3. Binance: The Best For Staking ETH On A Leading CEX

Binance

The best for staking ETH on a leading CEX

ETH Staking APY

1 – 2.79%

With a global availability in over 100 countries, Binance is the world’s leading crypto exchange. In the last 24 hours, the company accounted for $114 billion of digital asset trading volume on the spot and derivatives markets. Besides trading, the CEX also offers ETH staking via its massive ecosystem.

Review

Coverage

100+ Countries

Staking Fees

Included In The APY

Audit Status

Audited

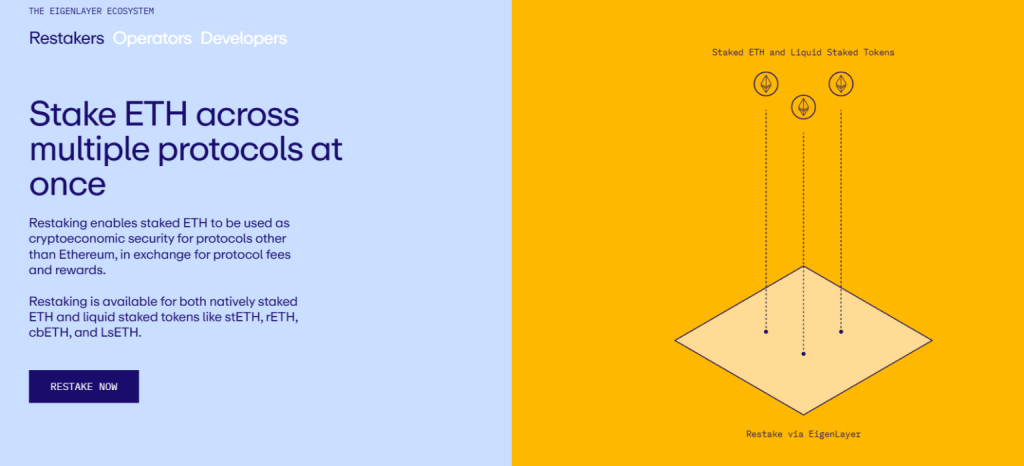

4. EigenLayer: The Best For Restaking Ethereum

EigenLayer

The best for restaking Ethereum

ETH Staking APY

3.6% + Restaking APY

Following Lido and Aave in the race, EigenLayer is the third-largest DeFi protocol by total value locked, featuring a TVL of nearly $11 billion. At the same time, it is by far the top restaking dApp on the market (although this is still a very new sector).

Review

Coverage

Global

Staking Fees

TBD

Audit Status

Audited

5. Coinbase: The Best For Staking ETH For US Users

Coinbase

The best for staking ETH for US users

ETH Staking APY

3.19%

Founded in May 2012, Coinbase is among the most established centralized exchanges on the market, which accounts for $5.5 billion 24-hour digital asset spot trading volume.

Review

Coverage

100+ Countries

Staking Fees

Included In The APY

Audit Status

Audited

The Verdict

ETH staking enables you to generate a passive income on your coins by putting them to work across various protocols. By doing so, you also help secure the Ethereum network through validating blocks on the blockchain.

In this guide, we have reviewed the best ways and platforms for staking Ethereum. Regarding the latter solutions, here’s a quick recap of the top services for staking ETH:

- Lido: The best for liquid staking ETH

- Nexo: The best for smart Ethereum staking

- Binance: The best for staking ETH on a leading CEX.

- EigenLayer: The best for restaking Ethereum

- Coinbase: The best for staking ETH for US users

Frequently Asked Questions (FAQ)

How does Ethereum staking work?

Ethereum staking refers to the process of locking your ETH in your wallet via a validator node or staking service to validate blocks on the blockchain. In exchange for helping secure the ecosystem, you receive staking rewards.

How do you stake Ethereum?

There are numerous ways to stake Ethereum, including:

– Solo staking

– Staking-as-a-Service (StaaS)

– Pooled staking

– Staking via a centralized exchange (CEX)

– Liquid staking

– Restaking

How much can I earn by staking Ethereum?

The APY you earn by staking Ethereum is based on the current market conditions, such as the total staked amount and network activity. If the total amount of staked ETH decreases and the network activity surges, you will likely earn more rewards.

In any case, it is a good idea to check the Ethereum staking APY via the websites of various providers to calculate your potential earnings.

How often are ETH staking rewards paid?

The frequency at which ETH staking rewards are paid depend on the method and platform you utilize for staking. For example, while liquid staking rewards are distributed instantly, you will likely have to wait multiple days until you can realize earnings with solo staking.

Where do ETH staking rewards come from?

ETH staking rewards are covered through the issuance of new Ethereum tokens. After the successful validation of a new block, the network rewards the validator with ETH.

How much ETH should I stake?

If you are solo staking or utilizing a Staking-as-a-Service (StaaS) provider, you must deposit at least 32 ETH to be eligible for staking rewards. However, you can stake a significantly lower amount of Ethereum tokens at CEXs and liquid staking, restaking, and pooled staking providers.

When did Ethereum switch to Proof-of-Stake (PoS)?

Ethereum switched from the energy-intensive and mining-based Proof-of-Work (PoW) consensus mechanism to the energy-efficient and staking-based Proof-of-Stake (PoS) on September 15, 2022. This is the date when the Merge took place, the most significant Ethereum hard fork to date, which reduced the blockchain’s power consumption by approximately 99.95%.

WRITTEN

Benjamin Vitaris

Seasoned crypto, DeFi, NFT and overall web3 content writer with 9+ years of experience. Published in Forbes, Entrepreneur, VentureBeat, IBTimes, CoinTelegraph and Hackernoon.