What Is Tezos?

Tezos is a blockchain network that enables users to participate in decentralized finance (DeFi), decentralized applications, and non-fungible token (NFT) projects. Tezos uses a blockchain-based governance mechanism that adopts and implements protocol upgrades chosen by voting proportional to users’ economic stake in Tezos. Unlike other blockchains, Tezos can be adapted without the need for hard forks or blockchain splits, which gives it the capacity to evolve without dividing the community. The network is fueled by the native XTZ cryptocurrency.

Key Takeaways

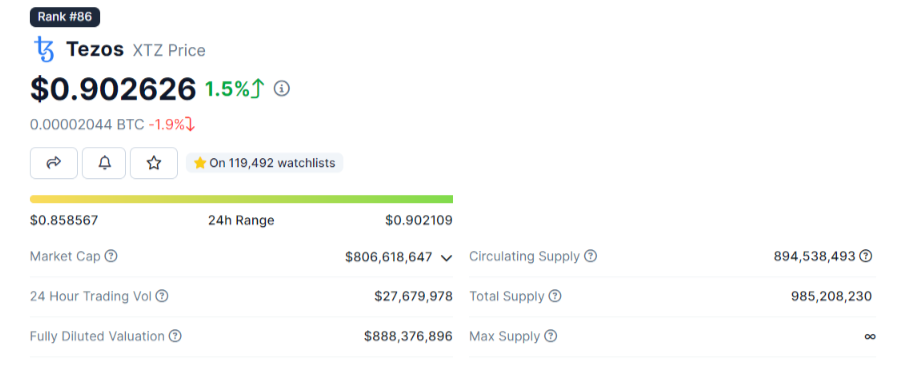

- Tezos is a layer-1 blockchain fueled by the XTZ cryptocurrency which consistently ranks among the top 100 cryptos by market capitalization.

- Tezos uses a proof-of-stake mechanism to validate blockchain transactions, which uses less energy than Bitcoin mining.

- The Tezos blockchain is designed to make it possible to adapt and evolve without relying on hardforks.

What Is The History of Tezos?

Tezos is a decentralized blockchain platform that was created by Arthur Breitman, a former engineer at Google X and Waymo, and his wife Kathleen Breitman, a former employee of the hedge fund Bridgewater Associates and R3, a software company1. The couple reportedly met at an Anarcho-Capitalist meetup in New York.

In 2014, Arthur Breitman published a white paper under a pseudonym outlining the principles behind Tezos while still working at Morgan Stanley. In July 2017, the Tezos Foundation, headed by Swiss entrepreneur Johann Gevers, organized an initial coin offering (ICO) for Tezos that proved to be the most successful ICO to date, raising $232 million2. The ICO drew 66,000 Bitcoins and 361,000 ethers in just 13 days, making it the seventh-largest crypto coin offering by January 2021.

The distribution of coins was delayed due to a power struggle between the Breitmans and Johann Gevers, who ultimately stepped down as Tezos Foundation president in early 2018. Nearly a year after the ICO, in June 2018, the Tezos Foundation said ICO “donors” awaiting their Tez allocations would have to first submit to know-your-customer (KYC) and anti-money-laundering (AML) verification.

In March 2020, the Tezos Foundation, the Breitmans, and the Breitmans’ company Dynamic Ledger Solutions settled for $25 million in a class action lawsuit brought on behalf of ICO participants looking to withdraw their investment.

Despite some early setbacks, Tezos has continued to evolve and develop, staying true to its ethos of being “a blockchain designed to evolve.”

How Does Tezos Work?

Tezos is a decentralized ledger that uses blockchain technology. It is similar to Bitcoin and Ethereum in that it is designed to facilitate peer-to-peer transactions without the need for intermediaries. Tezos is also designed to use smart contracts, which are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code3.

To become a network node operator in the Tezos network, a user must stake 8,000 XTZ, which is known as a roll. In return, the user earns a proportional share of Tez rewards for validating blockchain transactions4. Users with smaller Tez sums may delegate them to a network node known as a baker.

When additional Tez currency is created at the end of protocol upgrade cycles to compensate developers whose protocol upgrades are adopted, baker stakes are increased proportionately as an inflation adjustment5. Decisions on adopting protocol upgrades depend on voting by bakers in proportion to the size of their stakes, and the changes are automatically implemented throughout the blockchain. Final votes require the participation of owners holding at least 81% of the current coin supply.

All network activity and governance are decentralized, and the Tezos Foundation disclaims any role in its operations. Instead, it supports the development of Tezos infrastructure and dispenses grants and other funding to foster the adoption of the network.

In summary, Tezos is a blockchain network that allows for peer-to-peer transactions and uses smart contracts. The network is governed by a decentralized system of staking and voting, with baker nodes playing a key role in validating transactions and implementing protocol upgrades. The Tezos Foundation supports the development of the network but does not play a direct role in its operations.

How Does Tezos Remove The Need For Forks?

Tezos utilizes a unique approach to avoid the need for hard forks, primarily through its on-chain governance mechanism and self-amendment capabilities. Here’s how it works:

On-chain Governance:

- Stakeholder participation: XTZ token holders directly participate in protocol upgrades by voting on proposals. This ensures upgrades cater to the community’s needs and avoids minority dissent leading to forks.

- Formal amendment process: Proposals undergo a multi-stage process: origination, baking, and freezing. This allows ample time for discussion, testing, and refinement, minimizing surprise forks.

- Supermajority threshold: Amendments require a supermajority (usually 80%) approval to activate. This incentivizes compromise and discourages unilateral forks.

Self-amendment:

- Upgradeable protocol: Tezos’s core infrastructure is designed to be modular and upgradable without requiring a complete data structure change. This permits seamless integration of new features and bug fixes.

- Soft forks: For certain changes, soft forks can be employed. These remain compatible with older versions, gradually migrating the network to the new version without disruption.

- Hard forks as a last resort: While avoided, hard forks are technically possible for significant protocol changes. However, the high hurdle of community consensus makes them unlikely unless truly necessary.

This combination of on-chain governance and self-amendment empowers the Tezos community to evolve the protocol in a controlled and inclusive manner, minimizing the need for disruptive hard forks6.

What Are The Tokenomics of Tezos (XTZ)?

Tezos (XTZ) has a total supply of 985 million with 894 million coins in circulation. According to CoinGecko7 the maximum supply isn’t limited and with an $800 million market capitalization it ranks in the top 100 cryptos.

How Has Tezos (XTZ) Traded In 2023, And What Is The Tezos Price Prediction?

XTZ has posted a 16% gain in the past year which isn’t bad but considering the broader market rally is somewhat dissapointing8. Over the past five years, it gained just over 90% but it continues to trade for under $1 leaving it around 90% below its all-time high of $9.

Coincodex9 has set a high price target of $1.7 for 2024 which would mark a considerable gain from its current price point. They don’t expect it to trade above $4 any time this decade.

Changelly10 has issued a fairly optimistic price XTZ prediction for next year with some monthly targets exceeding $2.3. They expect its price to pick up considerable momentum later in the decade with a $12 end-of-year target for 2030.

Remember that crypto prices are extremely volatile, and you should always do your own research before risking your capital. Nothing in this post should be considered as financial advice.

Final Thoughts on Tezos

Tezos (XTZ) is an interesting crypto project that aims to solve several problems associated with Ethereum and other layer-1 chains namely scalability, cost and the tendency of forks to emerge. Its upgradeable protocol and unique governance system means that the community can upgrade the network without fracturing into two parties while its smart contracts allow for the deployment of DeFi and Web3 gaming applications. The XTZ token itself has been able to hold its own on the market but it has failed to grow into a top 10 token and the past year has seen it lag behind its competitors.

Frequently Asked Questions

What Is Tezos?

Tezos is an open-source blockchain platform like Ethereum, but self-upgradable via voting by token holders. Focuses on security, sustainability (proof-of-stake), and community governance. Powers Web3 apps and DeFi projects.

What Are the Best Tools for Tezos Blockchain Exploration?

There are several tools available for Tezos blockchain exploration, including Blockchair, TzStats, and Tezos.id. These tools allow users to explore the Tezos blockchain, view transaction history, monitor network activity, and track the performance of Tezos validators. Other useful tools for Tezos blockchain exploration include Tezos Nodes, Better Call Dev, and Tezos Terminal.

Where Can You Buy Tezos?

Where Can I Find Discussions About Tezos by the Community?

The Tezos community is active on various social media platforms such as Reddit, Twitter, and Telegram. Users can join Tezos-related subreddits such as r/tezos and r/tezosmarkets to engage in discussions about Tezos. Twitter is also a popular platform for Tezos-related discussions, with hashtags such as #Tezos and #XTZ frequently used by the community. Additionally, users can join Tezos Telegram groups such as Tezos Announcements and Tezos Traders to stay up-to-date with the latest news and developments.

WRITTEN

Peter Barker

Peter is an experienced crypto content writer and a DeFi enthusiast with more than 3+ years of experience in the space. Previously a journalist and news editor at a leading European news sourcing agency.