Stacks is a layer-2 blockchain network that enables decentralized apps, smart contracts and DeFi protocols to be built on top of Bitcoin. While Stacks and Bitcoin are separate blockchains, they can work together seamlessly. The STX token is used for transaction fees and deploying smart contracts on Stacks, and it can also be “stacked” to earn Bitcoin rewards.

Key Takeaways

- Stacks is a layer-2 blockchain network that allows decentralized apps and smart contracts to be built on Bitcoin.

- The STX token is the native cryptocurrency of the Stacks network and can be used for transaction fees and deploying smart contracts. It can also be “stacked” to earn Bitcoin rewards.

- Stacks is unique because it enables developers to build on top of Bitcoin, and it was the first token offering qualified by the SEC.

What Is The History Of Stacks (STX)?

The seeds of Stacks (STX) were sown in 2013 when Muneeb Ali and Ryan Shea, computer science students at Princeton University, envisioned a future where Bitcoin’s security and immutability could power a new era of decentralized applications1. Their vision materialized in 2015 with the unveiling of the Blockstack platform, a groundbreaking approach to building decentralized applications (dApps) on top of Bitcoin.

In 2018, Stacks launched its test net, paving the way for the main net launch in October of that year. With the mainnet online, Stacks enabled smart contracts, decentralized storage, and decentralized identity management on the Bitcoin blockchain. To incentivize developers to build on the Stacks ecosystem, the App Mining program was introduced, rewarding projects based on their user engagement.

In 2019, the SEC-qualified token sale of STX, the native cryptocurrency of the Stacks blockchain. The STX token ICO (Initial Coin Offering) was held between July 11 and September 11, 2019, on the CoinList platform. The ICO raised a total of $23.7 million, with an average price of $0.30 per STX token2. The ICO was divided into three rounds:

- Seed Round: $1.3 million raised from early investors

- Pre-Sale Round: $4 million raised from a limited group of investors

- Public Sale Round: $18.4 million raised from the general public

Finnaly, Stacks 2.0 mainnet went live on January 14, 20213. This marked a significant milestone for the Stacks ecosystem, as it enabled smart contracts and decentralized applications (dApps) to be built on top of the Bitcoin blockchain.

How Does Stacks Work? How Does It Enhance Bitcoin?

Stacks is a programmable blockchain that boasts smart contract functionality, enabling it to support decentralized applications (dApps) and non-fungible tokens (NFTs). What makes Stacks unique is that it leverages the Bitcoin blockchain as its base layer, unlike other programmable blockchains like Ethereum which start from scratch.

Stacks’ transactions are settled on Bitcoin, which provides a high level of security. Additionally, Stacks’ dApps can interact with Bitcoin even though it’s a separate blockchain.

Stacks has several noteworthy features that differentiate it from other blockchains:

- Proof of Transfer consensus mechanism: Stacks uses a consensus mechanism called “proof of transfer” that recycles Bitcoin’s proof-of-work system. This makes Stacks highly scalable and decentralized without causing additional environmental impact.

- Microblocks: To speed up transaction processing, Stacks uses microblocks. Although Stacks is limited to the same block times as Bitcoin, by dividing blocks into microblocks, it can reduce processing times from minutes to seconds.

- Clarity smart contract language: Stacks has its own smart contract language called Clarity. Clarity stands out from other smart contract languages because users can set up their own conditions for transactions and aren’t limited to preprogrammed conditions.

Stacks’ use of Bitcoin as its base layer and its unique features make it one of the leading solutiions for developers and users looking to build decentralized applications and tokens. Data from DeFi Lama shows that in 2023 the total value locked in Stacks contracts has seen a considerable growth4.

How Does the Stacks PoX Consensus Mechanism Operate?

Stacks uses a proof-of-transfer (PoX) consensus mechanism to validate transactions on the Bitcoin network5. Miners transfer their Bitcoin to other participants in the Stacks network, rather than burning them like in the proof-of-burn system. These transfers are used to validate transactions and the protocol randomly selects a miner to validate a block of Stacks transactions and receive a block reward in STX tokens.

To participate in the consensus process, Stacks token holders lock up their STX tokens and receive the transferred Bitcoin as compensation. The protocol chooses a winner at random and sends the Bitcoin to their crypto wallet address6.

Overall, Stacks’ proof-of-transfer system allows for efficient and secure validation of transactions on the Bitcoin network. By using a variation of the proof-of-burn system, Stacks ensures that miners are compensated for their efforts while also maintaining the integrity of the network.

| Feature | Stacks Pox | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|---|

| Consensus Mechanism | Utilizes Bitcoin’s UTXO (Unspent Transaction Output) model to secure the network | Miners compete to solve complex mathematical problems to validate transactions | Validators stake their cryptocurrency holdings to validate transactions |

| Scalability | Can handle a larger number of transactions per second than PoW | Limited scalability due to the computational power required for mining | Can achieve greater scalability than PoW, but still faces some limitations |

| Decentralization | Highly decentralized due to the large number of participants | Decentralized, but mining power can be concentrated in the hands of a few entities | Decentralized, but the distribution of validator power can be influenced by wealth |

| Governance | Governance decisions are made by the Stacks community | Governance decisions are made by miners | Governance decisions are made by validators |

What is STX? What are the Tokenomics of STX?

STX is the native cryptocurrency of the Stacks blockchain. It is used to pay transaction fees, stake and participate in the consensus process, and vote on governance proposals. STX tokens are also used for smart contracts and dApps on the Stacks blockchain which is a layer-2 deployed on Bitcoin.

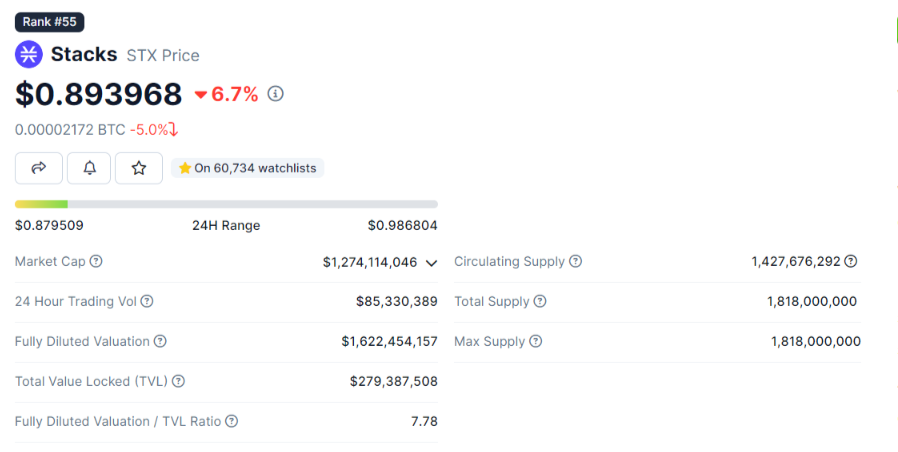

The tokenomics of STX according to CoinGecko7:

- Maximum Supply: 1.818 billion

- Circulating supply: 1.4 billion (December 2023)

- Market Cap: $1.2 billion

- Rank by Cap: #55

How Has Stacks (STX) Traded In 2023, And What Is The STX Price Prediction?

STX has outperformed the wider market with a year to date rally over 331% according to data from TradingView8. The rally has pushed the crypto’s market cap to well above $1 billion an derased some of the losses it suffered during the 2022 bear market. However, it still trades at a 73% discount on its all time high of $3.3.

The STX price prediction issued by Coincodex9 forecasts a mixed future with plenty of volatilty. They see STX trading as high as $3.3 in 2024 but also believe it could stagnate below $1. They don’t expect a new all time high before 2027 or 2028 at the earliest.

DigitalCoinPrice10 is very bullish on STX. Their avarage price target for 2024 is $2.17 and they expect a new all-time high in 2026.

Remember that crypto prices are extremely volatile, and you should always do your own research before risking your capital. None of the information presented here is investment advice.

Final Thoughts on Stacks (STX)

Stacks (STX) has merged the security and reliablity of Bitcoin with the utilty of dApps thorugh its layer-2 solution. This year the project’s TVL has experinced an impressive boost and the STX token’s price has rallied by an impressive 330% making it a top 50# crypto. The future of the project will depend on the team’s ability to roll out more solutions for developrs that want to build on Bitcoin instead of turning to traditional smart contract networks such as Solana and Ethereum.

Frequently Asked Questions

What Is Stacks?

Stacks is a layer-2 blockchain that builds on the security and infrastructure of Bitcoin, enabling smart contracts and decentralized applications (dApps) to be developed and deployed on the Bitcoin network. Stacks achieves this by utilizing a unique consensus mechanism called Proof of Transfer (Pox), which leverages Bitcoin’s UTXO (Unspent Transaction Output) model to secure the network.

Where Can You Buy STX?

What Are the Advantages of Using Stacks?

Stacks offers several advantages over traditional blockchain platforms, including its enhanced security, scalability, interoperability, and cost-effectiveness.

WRITTEN

Peter Barker

Peter is an experienced crypto content writer and a DeFi enthusiast with more than 3+ years of experience in the space. Previously a journalist and news editor at a leading European news sourcing agency.