What is Synthetix?

Synthetix is a DeFi protocol that allows for the creation of synthetic assets that track and provide returns for another asset without requiring ownership of it. In simpler terms, it allows users to gain exposure to real-world assets such as gold, silver, and fiat currencies, as well as cryptocurrencies, without actually owning them.

With the rise of decentralized finance (DeFi), Synthetix has been gaining popularity as a way to access these assets in a decentralized and trustless manner. The protocol is governed by a decentralized set of representative councils that are voted on by stakers, and is maintained and improved by a combination of core contributors, ecosystem partners, and community members.

In this article, we will explore what Synthetix is, how it works, and answer some frequently asked questions about the protocol.

Key Takeaways

- Synthetix is a protocol for the issuance of synthetic assets that tracks and provides returns for another asset without requiring ownership of that asset.

- The protocol is governed by a decentralized set of representative councils and is maintained and improved by a combination of core contributors, ecosystem partners, and community members.

- Synthetix allows users to gain exposure to real-world assets and cryptocurrencies in a decentralized and trustless manner.

Synthetix 101

Synthetix is an Ethereum-based protocol that allows users to issue synthetic assets in the form of ERC-20 smart contracts called “Synths.” These smart contracts track and provide the returns of another asset without requiring the user to hold that asset. Synths can represent a wide range of assets, including cryptocurrencies, indexes, inverses, and real-world assets like gold.

Synths can be traded on Kwenta, a decentralized exchange (DEX) that is built on top of the Synthetix protocol. To provide collateral against Synths that are issued, Synthetix’s native token, the Synthetix Network Token (SNX), is used. SNX is also used to incentivize users to stake their tokens and participate in the network’s governance.

In the decentralized finance (DeFi) ecosystem, Synthetix plays a crucial role in providing liquidity for synthetic assets. By allowing users to issue and trade Synths, Synthetix creates a more efficient market for these assets and provides users with greater flexibility and exposure to different asset classes.

How Does Synthetix Work?

Synthetix is a protocol that allows users to create synthetic assets called “Synths” that track the prices of other assets. Synths are issued on Ethereum and use decentralized oracles to track the prices of the assets they represent. This allows users to hold and exchange Synths as if they actually own the underlying assets.

Synths provide exposure to assets that are normally inaccessible to the average crypto investor, such as gold and silver, and let users trade them quickly and efficiently. Unlike tokenized commodities, Synths do not represent ownership of the underlying asset. Instead, they provide exposure to the price of the asset.

Because Synths are issued on Ethereum, they can be deposited on other DeFi platforms such as Curve and Uniswap and used to provide liquidity and earn interest. This helps to build mature markets by facilitating price discovery and hedging against volatility.

To begin trading Synths, users can use two methods: purchasing ether (ETH) on an exchange and exchanging it for sUSD on Kwenta, then exchanging for other Synths such as sBTC, or obtaining SNX tokens on an exchange and staking them on Mintr, a decentralized application created by Synthetix. When staking SNX, users can create Synths and trade them on Kwenta.

All Synths created by staking SNX tokens are backed by a 600% collateralization ratio, which is determined through community governance. Stakers must manage their ratio manually on Mintr by minting sUSD if it is too high, and burning sUSD if it is too low.

When staking SNX and minting sUSD, users take on debt reflecting the amount of sUSD that must be burned to un-stake their SNX. This debt, which also represents a proportion of all the debt on Synthetix, is denominated in sUSD and increases and decreases in accordance with the supply of Synths and their exchange rates.

Because the system’s total debt is distributed among stakers, they act as a “pooled counterparty” to trades. This means that counterparties are not needed when exchanging Synths, and instead, they can be converted directly through a smart contract. This system mitigates counterparty risks and slippage and ensures that there is sufficient liquidity for trading.

When staking tokens, users are eligible to receive two types of rewards if their collateralization ratio remains at 600%: staking rewards, denominated in SNX, and exchange fees from all Synth trades, denominated in sUSD. Exchange fees are distributed in accordance with the amount of debt each staker has issued. Linking rewards to the collateralization ratio ensures that Synths are always sufficiently backed by collateral.

If users want to un-stake their SNX tokens, they must burn sUSD. The amount of sUSD that must be burned to un-stake SNX fluctuates because the debt pool fluctuates. Users may need to burn more or less sUSD than they initially minted.

In summary, Synthetix is a protocol that allows users to create synthetic assets that track the prices of other assets, providing exposure to assets that are normally inaccessible to the average crypto investor. Synths are issued on Ethereum and use decentralized oracles to track the prices of the assets they represent. When staking SNX, users can create Synths and trade them on Kwenta. All Synths created by staking SNX tokens are backed by a 600% collateralization ratio, and stakers act as a “pooled counterparty” to trades. Users can earn rewards by staking tokens and providing liquidity, and if they want to un-stake their SNX tokens, they must burn sUSD.

What is Kwenta?

Kwenta is a decentralized exchange that allows users to trade Synths, which can also be traded across a variety of DeFi protocols. Unlike other DEXs, Kwenta does not have an order book and instead utilizes peer-to-contract trading. This means that all trades are executed against a smart contract. Chainlink oracles provide price feeds, which are used to set an exchange rate for each asset traded on Kwenta.

Kwenta users can buy and trade a range of tokens from different cryptocurrencies and inverse cryptocurrencies, to synthetic gold and silver, and synthetic fiat currencies.

Synthetix offers two synthetic cryptocurrency indexes: sDEFI1, which tracks a basket of DeFi assets, and sCEX2, which tracks a basket of centralized exchange (CEX) tokens. Both asset baskets were voted on through community governance.

A variable fee between 0.02% and 0.1% is levied on each trade and sent to a pool where it can be claimed by SNX stakers3. Kwenta offers an efficient, flexible, and cost-effective trading experience for users. The platform provides deep liquidity and up to 50x leverage4 on a variety of assets.

Overall, Kwenta is a popular decentralized trading frontend that offers an interface and tooling for a rapidly expanding list of assets and derivatives including spot and futures. All synth and futures trading on Kwenta uses the Synthetix Protocol.

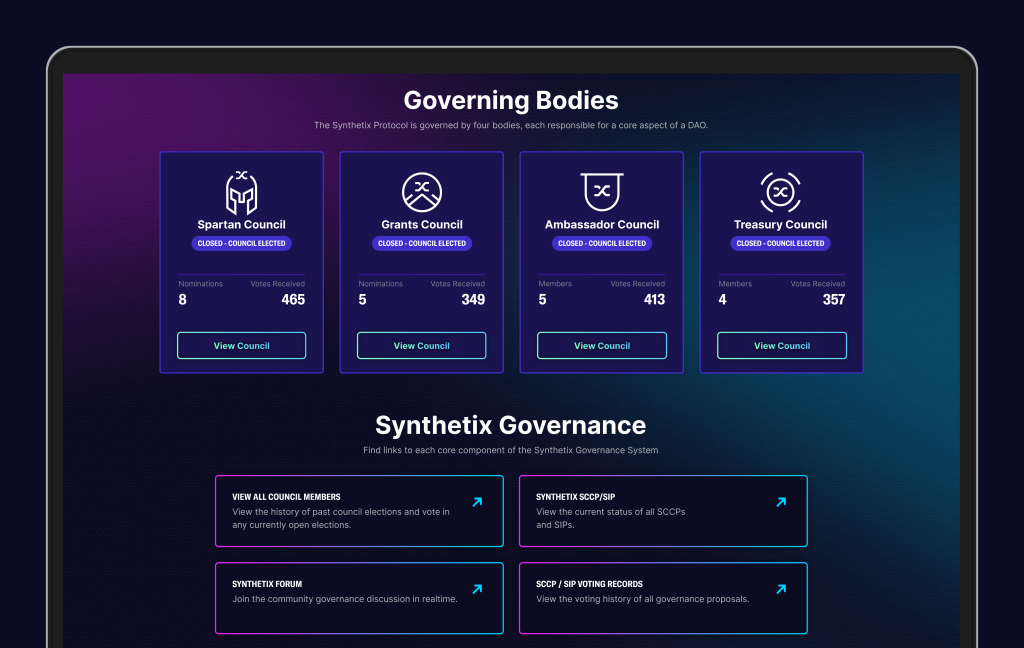

Synthetix Governance

The Synthetix Protocol operates decentrally through a system of governing bodies. Essential components of this decentralized framework include the Spartan Council, Treasury Council, Ambassador Council, and Grants Council, all of which are elected by Synthetix Stakers.

In facilitating the governance process, key artifacts such as Synthetix Improvement Proposals (SIPs) and Synthetix Configuration Change Proposals (SCCPs) play a crucial role. These documents effectively outline proposed alterations to the Synthetix Protocol. The execution of these changes is carried out by Synthetix Core Contributors, who are overseen by the Core Contributor Committee.

These members can propose, vote on, and implement changes to the protocol through a transparent and democratic process. The governance structure of Synthetix allows for decentralized decision-making and community participation.

Overall, the governance structure of Synthetix is an important aspect of the platform’s success. It allows for community participation, transparent decision-making, and ensures that the platform remains decentralized and censorship-resistant.

Frequently Asked Questions

What is the purpose of the Synthetix platform?

Synthetix is a decentralized protocol built on the Ethereum blockchain that enables the creation of synthetic assets, or “synths,” which are tokens that track the price of real-world assets such as commodities, stocks, and currencies. The purpose of the Synthetix platform is to provide users with access to a wide range of synthetic assets that can be traded on a decentralized exchange.

How does Synthetix integrate with Optimism?

Synthetix recently announced its integration with Optimism, a layer-two scaling solution for Ethereum. This integration will allow Synthetix to increase its transaction throughput and reduce gas fees for users. The integration will also enable Synthetix to offer faster and cheaper trades, which will make the platform more accessible to a wider range of users.

What are the new features in Synthetix V3?

Synthetix V3 introduces several new features, including multi-collateral staking and marks a transition towards becoming a permissionless derivatives liquidity platform. With multi-collateral staking, users can stake any governance-approved collateral into pools, which is then used to provide liquidity to derivative markets. A feature flag was raised during the Synthetix V3 Alpha/Beta phases that disabled the permissionless creation of pools. When governance votes to remove this feature flag, participants will once again be granted the ability to create their own pools permissionlessly.

How can developers contribute to the Synthetix GitHub repository?

Developers can contribute to the Synthetix GitHub repository by submitting pull requests, reporting issues, and participating in community discussions. The Synthetix team welcomes contributions from developers of all skill levels and backgrounds.

WRITTEN

Mariquita de Boissière

Through storytelling and detailed research, Mariquita connects the brightest developer talent and most motivated community members to web3 changemakers. From contributing top-of-funnel educational content for web3 onboarding projects like Surge.io to collaborating with Hedera’s HBAR Foundation on content marketing strategy, Mariquita has worked with some of the top artists, founders and builders in the space.