Celestia is a modular blockchain network that aims to tackle the industry’s data availability problem. As the first chain to address this issue, Celestia streamlines blockchain development and scales with the number of users within its ecosystem. Powering its platform, TIA is the project’s native token that fulfills a wide range of use cases in the network.

This article will introduce you to Celestia and its native TIA token, touching on the following key points and topics:

- What is Celestia, and what should readers know about its history

- An introduction to modular blockchains

- How does Celestia work, and what makes it unique

- The essentials about Celestia’s native TIA token, its market performance, tokenomics, and use cases

- Celestia’s competitors, including NEAR DA, Eigen DA, and Avail

- Whether a second TIA airdrop will take place in the future

- Celestia’s roadmap and future plans for the community

- Our verdict

Let’s dive in!

Key Takeaways

- As the world’s first modular data availability blockchain network, Celestia rolled out its mainnet and issued over $300 million of native TIA tokens on October 31, 2023.

- Celestia’s history dates back to June 2019, when the LazyLedger whitepaper was released by Mustafa Al-Bassam.

- As of January 31, 2024, TIA has an all-time ROI of 681%, with the token fulfilling a variety of use cases, from staking and community governance to data availability transactions.

- Celestia’s primary competitors are NEAR DA, Avail, and EigenDA.

- Celestia aims to tackle the data availability problem via DAS technology, which aligns closely with Ethereum’s rollup-centric roadmap.

The Brief History of Celestia

Before its rebrand in June 2021, Celestia was known as LazyLedger. The modular data availability blockchain network’s history dates back to June 2019, when Celestia Labs co-founder and CEO Mustafa Al-Bassam authored and released the project’s official whitepaper.1

After several months of development, Celestia released its minimum viable product (MVP) in the form of a data availability sampling client in June 2021, the same month the project’s rebrand took place. Furthermore, May 25, 2022 marked the launch of the Celestia Mamaki testnet, the upgraded version of the now-defunct devnet.

Finally, on October 31, 2023, Celestia’s mainnet beta went live. Simultaneously, the project’s native TIA token was rolled out to the community on the same day, which marked the first modular blockchain data availability network’s launch.2

Celestia in a Nutshell

Celestia is a blockchain network that Web3 developers can utilize as a data availability layer for publishing transaction data and making it available for anyone to download. Due to its modular design, anyone can launch their own blockchain seamlessly without the necessary need for a validator set.

The project addresses blockchains’ data availability issue, which have been limiting their scalability with additional negative impacts on their security and decentralization. With Celestia, chains can verify data availability via resource-limited light nodes instead of requiring full nodes to download and validate all records.

As a consensus layer, nodes within Celestia’s network review and validate the records stored on the ledger. Consequently, Layer 2 (L2) rollups can execute transactions with high throughput off-chain, utilize Celestia as a data availability layer, and rely on Ethereum for settlement and additional security.

Built via Cosmos SDK, Celestia’s modular data availability network consists of a Proof-of-Stake (PoS) blockchain that utilizes a modified version of the Tendermint consensus algorithm.

To date, Celestia has closed multiple funding rounds, collecting a total of $56.5 million from investors, which include prominent organizations like Polychain Capital, Interchain Foundation, and Binance Labs.3

What is Blockchain Modularity?

Blockchain modularity refers to separating the essential functions a distributed ledger performs, including data availability, consensus, settlement, and execution. As the first approach to building chains, the monolithic design requires blockchains to carry out all these tasks. Bitcoin, Ethereum, and the most popular distributed ledger technology (DLT) solutions are monolithic.

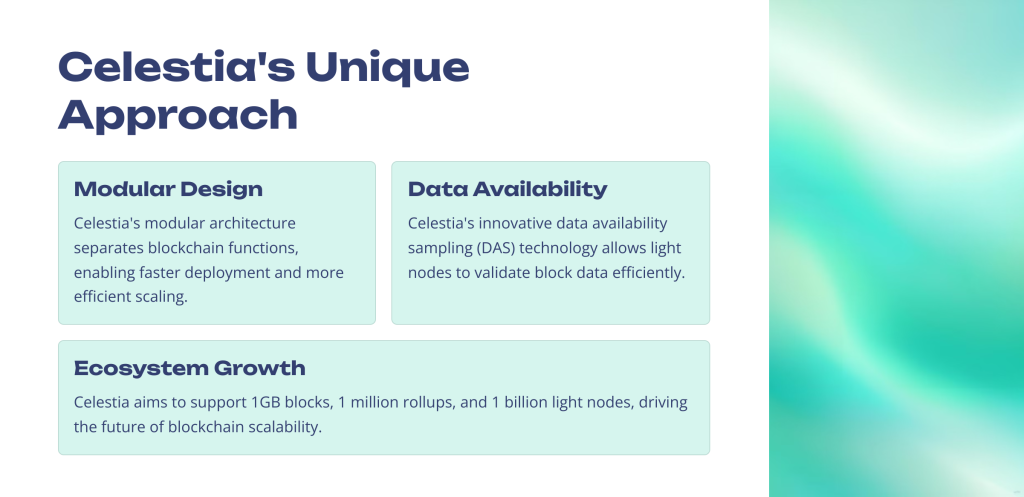

On the other hand, a modular design divides the DLT network into smaller parts that can be exchanged or replaced. Instead of being responsible for all essential tasks, modular blockchains specialize only in a single or a couple of functions. For example, Celestia’s specialty is data availability and consensus, while execution is the main focus for rollups.

As developers don’t have to build every functionality from scratch, modular blockchains are faster and easier to deploy. Moreover, offloading certain tasks to other specialized chains enables chains with modular designs to scale more efficiently.

| Features | Monolithic Blockchains | Modular Blockchains |

| Flexibility And Adaptability | Limited adaptability, response to system overloads, and customization | Enhanced design flexibility and adaptability with specialized chains for certain tasks |

| Scalability | Scalability comes at the expense of security or decentralization | Optimized modules for execution and speed can tackle certain scalability-related challenges |

| System Upgradeability | Challenging with extensive downtime | More seamless with minimal downtime |

| Deployment Complexity | Slower and more complex due to the need to establish security properties and other components | Faster and easier due to the plug-and-play functionality of modules |

| Security | Node validation of on-chain transactions | Depends on module and protocol security |

What Makes Celestia Unique?

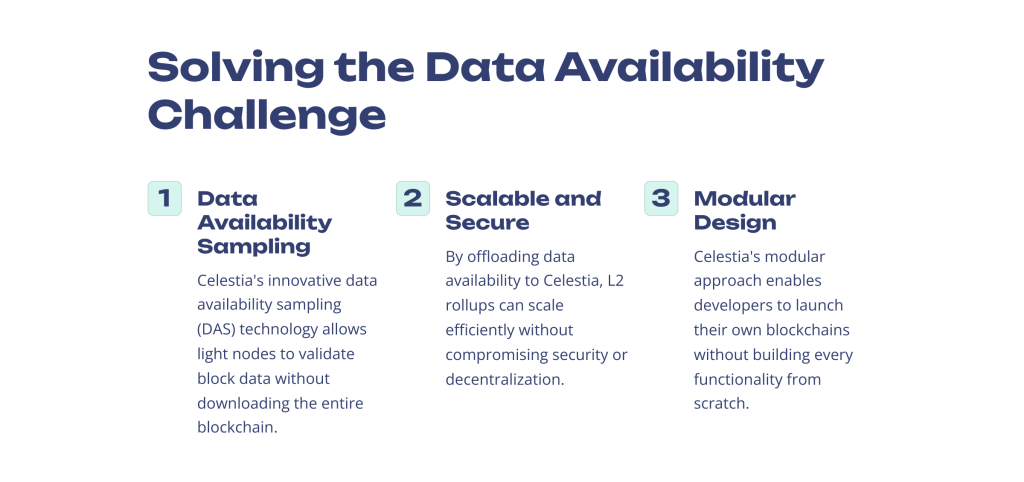

Celestia’s uniqueness lies in its pioneer solution to a critical market challenge: the data availability problem.

Data availability refers to the blockchain network’s ability to guarantee that all ecosystem participants have access to the information that’s necessary to validate a block. But to verify records within a block, full nodes must download the chain’s complete data to check whether every transaction recorded on the ledger is valid.

In the case of fast-growing blockchains, the above task could easily become challenging due to the massive amount of resources and disk space required to perform it. Moreover, relying on full nodes to verify each transaction that has ever been recorded on the chain to validate new blocks is inefficient, negatively impacting the network’s scalability.

To tackle this challenge, Celestia leverages data availability sampling (DAS). Unlike full nodes, light nodes can’t download the entire blockchain’s data or verify transactions. Instead, they only download the block header, which includes basic details about the block. However, with DAS technology, Celestia makes it possible for light nodes to sample a tiny random portion of block data to validate whether it has been published and the information inside is available.

In Celestia’s network, light nodes perform multiple rounds of random sampling. The more selection rounds they complete, the higher the confidence in the data’s availability becomes. To consider the available block data, light nodes must reach a predetermined confidence level (e.g., 99%).

By relying on light nodes for data availability, Celestia helps L2 rollups and other chains scale more efficiently without compromising their security or decentralization.

Introducing Celestia’s Native TIA Token

TIA is Celestia’s native token that fulfills a wide range of use cases within the ecosystem. The project first issued TIA on October 31, 2023 as part of an airdrop alongside its mainnet launch.

During genesis, Celestia airdropped 60 million tokens (approximately 6% of the total supply) to 580,000 participants, including developers, active stakers, and other Ethereum, Ethereum-based rollup, Cosmos, and Osmosis addresses.4

Market Performance

Source: CoinGecko

On October 31, 2023, TIA was trading between the low of $2.18 and the high of $2.45. Since its launch, the cryptocurrency’s price has grown significantly to $17.04, featuring an all-time return on investment (ROI) of 681% as of January 31, 2024. Currently, TIA’s market cap stands at nearly $2.75 billion, with an over $145 million 24-hour trading volume.

Tokenomics

TIA has no hard cap on its maximum supply. Out of the total genesis supply of 1 billion coins, nearly 161 million Celestia tokens are currently in circulation.

According to the project’s website, TIA will inflate at a scheduled rate of 8% in the first year. After that, the token’s inflation rate will decrease by 10% every year until reaching an annual inflation floor of 1.5%.5

Use Cases

TIA functions as both a utility and a governance token, fulfilling the following use cases within the Celestia ecosystem:

- Developers pay a TIA-denominated fee for data availability.

- Similarly to the role ETH fulfills in Ethereum-based rollup networks, developers can also use Celestia’s native coin as a currency and a gas token.

- Token holders can delegate their coins to a Celestia validator to help secure the ecosystem and receive a part of the staking rewards.

- By staking their TIA, token holders can participate in Celestia’s decentralized community governance process.

Celestia vs. Competitors: Meet NEAR DA, Avail, and EigenDA

Rollups play an integral role in Ethereum’s roadmap. As rollup solutions continue to gain traction in the Web3 community, data availability is increasingly becoming the center of attention among developers.

Due to the above, multiple data availability solutions have recently emerged as Celestia’s competitors. The following projects are some of the most notable players in this field:

| Celestia | Ethereum | Eigen DA | Avail | NEAR DA | |

| Block Time | 15 sec | 12 sec | N/A | 20 sec | 1.2 sec |

| Consensus Algorithm | Tendermint | Casper and GHOST | None | GRANDPA and BABE | Nightshade |

| Time To Finality | 15 sec | 12 min | 12 min | 20 sec | 2 sec |

| Data Availability Sampling (DAS) | Supported | Not supported | Not supported | Supported | Not supported |

| Encoding Proof Scheme | Fraud proofs | Validity proofs | Validity proofs | Validity proofs | N/A |

| Light Node Security | Honest majority | Honest majority | N/A | Honest majority | N/A |

- NEAR DA: Near Foundation, the non-profit organization that’s behind the L1 blockchain NEAR, joined in the data availability race last year. On November 8, 2023, the company announced NEAR Data Availability Layer (NEAR DA) at its annual conference. With its initial users including Starknet’s Madara, Movement Labs, and Caldera, NEAR DA’s data posting expenses could be 8,000 times more cost-efficient than on Ethereum.

- Avail: Headed by Polygon co-founder Anurag Arjun, Avail is another blockchain data availability solution rivaling Celestia. With its testnet announced a day before NEAR DA in November 2023, the project was originally known as Polygon Avail but became independent from Polygon Labs in March 2023. What makes Avail stand out from the crowd is its utilization of Polkadot’s BABE block production mechanism and GRANDPA finality gadget.

- EigenDA: Built on top of Ethereum, EigenDA is a blockchain data availability layer developed by EigenLabs, the creator of the EigenLayer Ethereum restaking primitive. According to its developers, EigenDA is the first actively validated service (AVS) to launch on EigenLayer. In other words, it sources validation from EigenLayer while being built on restaking. Currently, EigenLabs’ data availability layer is expected to enter its testnet’s second stage in H1 2024.

Celestia is one of the most popular data availability solutions on the market. However, each of its competitors leverages a unique approach, along with Ethereum integration and a reliable service.

Will a Second Celestia (TIA) Airdrop Take Place in the Future?

As of January 29, 2024, no announcement has been made about a second TIA airdrop on Celestia’s official channels. That said, TIA stakers could potentially claim the airdropped tokens of partner projects as rewards. Recently, both Saga and Dymension have announced airdrops for Celestia stakers.6

However, crypto users should be aware of potentially fraudulent schemes targeting the Celestia community. For example, one unverified article on Medium claims that the second part of the TIA airdrop is currently active, encouraging victims to connect their cryptocurrency wallets to a fake, dubious website.

To stay safe, it is crucial for crypto users to rely exclusively on verified sources (e.g., Celestia’s official X account or blog) and avoid visiting fraudulent websites. Readers should also refrain from sharing their wallets’ private keys with anyone, as doing so could compromise their security and may result in a loss of funds.

What Does Celestia’s Roadmap Hold for Users?

After launching its mainnet beta in October 2023, the Celestia team has also revealed important details about the project’s future plans.7 These include:

- Optionally raising the block size limit from 2MB at genesis to up to 8MB via on-chain governance.

- Introducing support for historical blob data pruning, which is expected to substantially decrease node storage requirements.

- Allowing L2s to utilize Celestia for modular data availability through the deployment of Blobstream to Ethereum’s mainnet.

- Enhancing the efficiency of block and mempool network propagation for bigger block sizes.

- Achieving full level 3 and above light node security via optimized support for bad encoding proofs and block reconstruction.

- Monitoring light node networks. The goal is to achieve level 4 light node security while determining the maximum block size suitable.

- The team will also roll out either a new partial node type or fraud proofs for light nodes. While the prior will verify Celestia’s L1 state transitions, the task of fraud proofs will be to verify invalid L1 state transitions.

Besides the above, Celestia’s ultimate goal is for its network to support 1GB blocks, 1 million rollups, and 1 billion light nodes.

Celestia: The Verdict

With data availability sampling, Celestia aligns with Ethereum’s rollup-centric roadmap and facilitates the crypto market’s technological advancements. Moreover, the ecosystem’s modular design has the potential to take blockchain development to the next level in the coming months and years. In any case, Celestia is expected to have a great impact on cryptocurrency market participants.

Frequently Asked Questions (FAQ)

How does Celestia stand out from the crowd as a blockchain platform?

Created via the Cosmos SDK, Celestia’s Proof-of-Stake (PoS) distributed ledger ecosystem leverages a modified version of the Tendermint algorithm for consensus. However, what really makes the blockchain platform unique is its solution to the data availability problem. As the first chain to address this challenge, Celestia leverages DAS technology to validate whether a block’s data is available through light nodes. This enhances scalability and throughput as nodes are no longer required to download the full transaction data of the chain.

Furthermore, Celestia is a modular blockchain. Instead of following the standard design of monolithic blockchains like Bitcoin and Ethereum, it separates the basic functions the chain performs, including settlement, execution, consensus, and data availability. This makes the deployment of such specialized DLT networks more seamless and flexible while offering significant improvements in scalability.

What are Celestia’s core features and advantages for users?

Due to its modularity, Celestia offers increased flexibility and more streamlined deployment for developers. Combined with data availability sampling, this design allows the project to achieve enhanced scalability without undermining its security and decentralization.

What should investors know about Celestia’s tokenomics?

Currently, out of its total genesis supply of 1 billion tokens, nearly 161 million TIA is in circulation. While there is no hard cap on the cryptocurrency’s maximum supply, its inflation rate is scheduled to decrease by 10% every year from the initial rate of 8% to the annual inflation floor of 1.5%. From community governance and staking to serving as a currency and a gas token, TIA fulfills several use cases in Celestia’s ecosystem.

Which wallets are Celestia tokens (TIA) available on?

Unlike tokens that utilize Ethereum’s popular ERC-20 standard, only a handful of wallets support TIA. The most popular wallet solutions for storing, sending, receiving, and interacting with Celestia’s native digital asset are Ledger, Leap, Keplr Wallet, and Cosmostation.

What are the details of Celestia’s token launch?

Celestia’s token launched on October 31, 2023, the same day the project released its mainnet beta to the public. At the time, the modular data availability blockchain issued $300 million of TIA, airdropping 60 million coins to 580,000 users.

Is Celestia token (TIA) already trading on major crypto exchanges like Binance?

Yes, Celestia’s native TIA token has already been listed on major exchanges, including Binance, Bybit, and OKX. After registering an account and passing mandatory Know Your Customer (KYC) and Anti-Money Laundering (AML) measures, users can trade the cryptocurrency on any of the supported platforms.

WRITTEN

Benjamin Vitaris

Seasoned crypto, DeFi, NFT and overall web3 content writer with 9+ years of experience. Published in Forbes, Entrepreneur, VentureBeat, IBTimes, CoinTelegraph and Hackernoon.